Operational risk

Isda calls for trade automation

Implementation Outlook

Mark up the scorecard

Sergio Scandizzo and Roberto Setola explore the application of a scorecard approach to the measurement of operational risk, assessing both its reliability as a risk-management tool and the practicalities of its implementation.

Mark up the scorecard

Sergio Scandizzo and Roberto Setola explore the application of a scorecard approach to the measurement of operational risk, assessing both its reliability as a risk-management tool and the practicalities of its implementation.

End of the line. All change

The Financial Services Authority has released an update to CP171, its consultation paper on conflicts of interest within investment research. Now its impact on the future of credit research is becoming clearer, as Hardeep Dhillon discovers.

German banks plan op loss data consortium

A number of German public-sector banks will start pooling operational loss data next year, in a bid to create an op risk loss database that could, they say, eventually include banks from other European countries.

Moody's assessment approach 'evolving', says new executive

In an exclusive interview with Operational Risk, an executive from Moody's Investor Services, the US-based rating agency, said the firm's approach to operational risk assessments is "evolving".

US brokers spending less than expected on Basel II-related IT infrastructure, says TowerGroup

US brokers will only be spending between $6 million and $8 million on IT infrastructure for Basel II compliance, according to research by TowerGroup, a Massachusetts-based financial services research and advisory firm.

Mind the gap

UK mortgage lenders are grappling with Basel II. But there are still concerns about a credit risk management gap between the large and small lenders.

Sponsor's article > Credit risk catches up

When Basel II was first proposed in 1999, credit risk models lagged way behind market risk models. But that's changed, which means we need less prescriptive rules for determining credit risk capital.

Nuclear renaissance

New frontiers

Kamakura upgrades credit default prediction software

Hawaii-based risk technology vendor Kamakura has upgraded its default probability calculation software.

a changing landscape

Derivatives debate

Patience pays off

Platinum Capital Management has launched a new distressed debt fund after a long process of analytical research

Every last drop

Strategy forum

Pricing credit risk

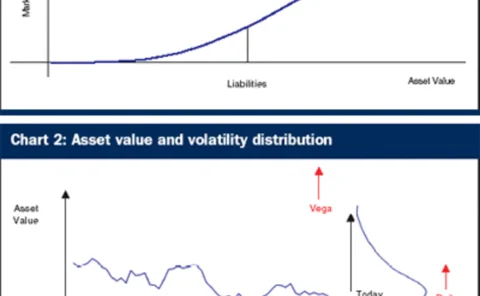

Merton models

Mark up the scorecard

TECHNICAL FOCUS

EU Commission to launch consolidated database

ANTI-MONEY LAUNDERING

What’s coming, and when

REGULATORY UPDATE

BITS issues guidelines for IT outsourcing

TECHNOLOGY

Regulatory briefs

REGULATORY UPDATE

Moody’s assessment approach ‘evolving’, says new executive

IMPLEMENTATION OUTLOOK