Credit risk

Rating the future: the investors’ perspective

Regulators have had their say; the agencies themselves have implemented changes to methodologies and processes; but how would investors fix the credit ratings business?

Real-time counterparty credit risk management in Monte Carlo

Real-time counterparty credit risk management in Monte Carlo

Credit ratings: the legal perspective

Securitisation lawyer Jonathan Walsh explains what regulatory and legal changes will mean for the rating agencies

Profile: Diana Higgins, Director Crediten

Turning points: Diana Higgins, Director, Crediten

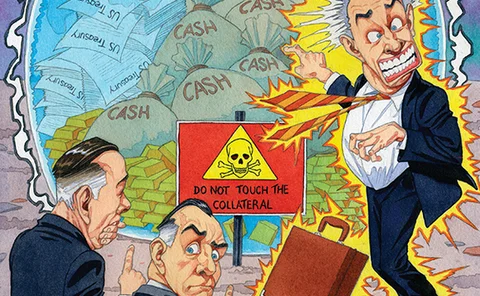

Collateral: look, but don’t touch

Collateral: look, but don’t touch

New Zealand banks still prone to offshore wholesale funding risks

The asset quality and capitalisation of New Zealand banks remains strong but dependence on wholesale funding is still a risk, say credit rating agencies.

Quants continue to criticise counterparty risk measures

Adjusting the adjustments

An analytical framework for credit portfolio risk measures

An analytical framework for credit portfolio risk measures

Greek budget cuts raise default concerns

Markets prepare for the worst as Athens unveils new tougher austerity measures; IMF managing director Dominique Strauss-Kahn says cuts are necessary

Taiwanese banks exposed to domestic property and China risks, says Fitch

Fitch Ratings believes the cost of funding for Taiwanese banks could jump nearly 200 basis points should Taiwan or China property prices fall sharply. The country's banks are also prone to any slowdown in global economic growth.

FSB concerned about counterparty and liquidity risk in ETF market

FSB warns of counterparty risk due to rapid growth of synthetic ETF market; also expresses concern about on-demand liquidity in stressed conditions, particularly linked with vertically integrated providers.

HKMA warns on US dollar funding risk from China corporate lending

Hong Kong branches of Chinese commercial banks are increasingly lending US dollars to state-backed enterprises. The surge in dollar demand from Chinese corporates comes as lending is squeezed onshore by Beijing's efforts to limit the credit growth of…

Isda AGM: dealers, CCPs debate risks of lowering bar to entry

Weaker clearing members could be overstretched by a crisis, dealers warn - but LCH.Clearnet and CME differ on the risk of wider access

Non-US sovereigns should collateralise swaps, say US bank regulators

Progress towards sovereign collateral posting has been slow. Now, US regulators are proposing to make it mandatory - for all non-US entities

HK Lehman minibond resolution may be approved despite bond-holder dissent

Despite objections submitted to the US bankruptcy court from the holders of Lehman Brothers minibonds, the latest resolution effort to reach settlement on the sale of credit-linked notes to retail investors in Hong Kong may still be approved, as the 75%…

Risk Europe: S&P slammed for linking Greece, Portugal downgrades to ESM

Eurozone bail-out vehicle doesn't hurt existing bondholders, EC official argues

Collateral management: Firms face up to regulatory challenge

Balancing the books

Risky funding with counterparty and liquidity charges

Risky funding with counterparty and liquidity charges

Sovereign risk weights under threat

Weight gain

A practical challenge for collateral optimisation

Collateral conundrum

Capturing credit correlation between counterparty and underlying

Capturing credit correlation between counterparty and underlying

China and HK central banks close to finalising new CNH clearing arrangement

Market participants are close to completing the legal and operational details relating to a new custodian account arrangement that would allow the city's participating banks in offshore renminbi to take credit risk against the People's Bank of China…

Electronic trading and clearing of NDFs poised for growth in Asia

Asian regulators are expected to closely follow their peers in the US and Europe in demanding swap execution facilities and over-the-counter derivatives clearing in Asia. This may bolster e-trading for NDFs based on Asian currencies