Credit risk

Credit rating agencies: what are the alternatives for energy markets?

Beyond the big three

European capital rules could squash CVA feedback loop

European capital rules could squash CVA feedback loop

Eurex to offer full segregation in March launch of OTC clearing

Eurex Clearing plans to be the first OTC clearer to offer full segregation of collateral when it launches in March - demand has risen since MF Global collapse

Basel 2.5: US ratings workaround criticised

Workaround woes

Conversion of upfront CVA into running CVA

Conversion of upfront CVA into running CVA

Japan still backs EFSF despite threat to AAA rating

The expectation that Standard & Poor’s decision to downgrade France and Austria will have a knock-on impact on the EFSF will not deter further Japanese investment in its bonds, says Japanese official

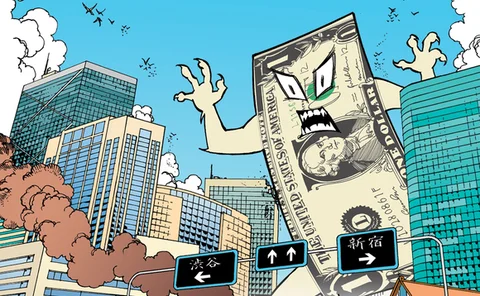

The dollar dominance dispute

Disputes over the valuation of collateralised derivatives trades have pushed the industry to develop a new standard credit support annex. A solution has been proposed – but some Asian banks have raised concerns about the dominant role given to the US…

European Insurers face downgrades amid continuing sovereign debt crisis

Generali subsidiaries and Groupama receive downgrades; Aviva placed under review

The CVA-CDS feedback loop

The CVA-CDS feedback loop

Quants call for Isda to clarify close-out values

Leading quants highlight ambiguity in Isda master agreement - but warn that resolving the issue could worsen systemic risk

Cutting Edge introduction: clarity needed on credit adjustments

Credit and credibility

Cutting Edge: the year of CVA

The year of CVA

Close-out convention tensions

Close-out convention tensions

New standard CSA too dollar-centric, say Asian banks

Banks in Asia-Pacific complain about dollar dominance in new standard CSA – prompting Isda to rethink its plans

MF Global: non-US clients caught in cross-border collateral trap

Omnibus structure meant clearing clients of MF Global outside the US were asked to double up on collateral payments. Use of the structure for OTC markets is now in doubt

Is asset-backed credit support an option for energy firms?

Coming up with the money

Eksportfinans faces collateral questions following downgrade

Junk-rated export lender says it has enough reserve liquidity to meet obligations while it is being wound up - but dealers are not convinced

ECB offers CSDs financial incentives for early T2S adoption

European Central Bank offers central securities depositories (CSDs) financial incentives to sign up to T2S early; governing council gives CSDs until the end of April to agree

Banque de France outsources collateral management

French central bank agrees collateral management deal with Euroclear France; entire French banking community will use new system next year

Commission unveils contentious Eurobond proposals

European Commission unveils three options for Eurobonds in bid to restore stability in Europe; analysts say the measures are politically unviable and ineffective

EU proposals for credit ratings rules require close monitoring by hedge funds

Draft language could affect the way hedge funds perform their own internal credit analysis