Risk magazine - Volume16/No8

Articles in this issue

Betting on recovery

In March 2002, on a voyeuristic impulse, I went to Enron’s bankruptcy auction at the firm’s offices in London’s smart SW1 district. From the top floor there was a view of the private royal gardens of Buckingham Palace; and from there, Enron’s executives…

Technology briefs

Systems

Job moves

People

A change for the better

Profile

Unexpected recovery risk

For credit portfolio managers, the priority is to properly incorporate recovery rates into existing models. Here, Michael Pykhtin improves upon earlier approaches, allowing recovery rates to depend on the idiosyncratic part of a borrower’s asset return,…

BNP Paribas beats SG for ZCM assets

New angles

A plague on arbitrageurs

Cover story

Job Moves

People

A Nordic niche for CLS

Liquidity risk

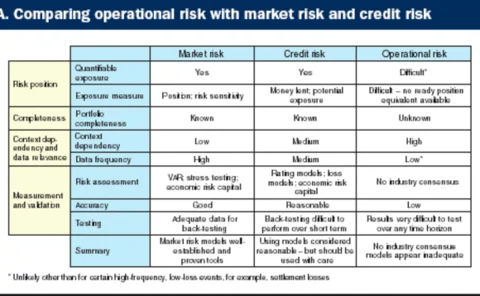

The operational risk pyramid

Risk analysis

The dividend divide

Cover story

Technology briefs

Systems

Merrill to launch options on vol swaps

New angles

Swaps platforms draw fire

New angles

Global derivatives rankings 2003

Rankings

Back-up systems key to blackout recovery

New angles

Ultimate recoveries

Recovery rates - Cutting edge

A false sense of security

Recovery rates - Cutting edge

News

Risk news

Back-up systems key to blackout recovery

New angles

Does CP3 get it right?

Basel II

Precipice bond structure defended

New angles

Reason for hope

Risk analysis

The cutting hedge

Loan hedging

Instant anguish

Comment

The billion-dollar man

Profile

Comment

Introduction

Where to look

Introduction

Winds of change

Introduction

CSFB at the edge

Profile

Vibrant volumes

Exchanges

Getting ready for IAS

Accounting

Ready and waiting

Basel Accord

Retail credit innovations

Credit derivatives

CBOE prepares for battle

Equity options

The strong dollar challenge

Corporate hedging

The objective strategy

Merger arb

The demands of innovation

Credit data

Enter Big Brother’s bigger brother

Data monitoring

Questioning convergence

Securitisation

Missing the train

Listed swap products

Unexpected recovery risk

For credit portfolio managers, the priority is to properly incorporate recovery rates into existing models. Here, Michael Pykhtin improves upon earlier approaches, allowing recovery rates to depend on the idiosyncratic part of a borrower’s asset return,…

A false sense of security

Credit portfolio models often assume that recovery rates are independent of defaultprobabilities. Here, Jon Frye presents empirical evidence showing that such assumptions arewrong. Using US historical default data, he shows that not only are recovery…

Ultimate recoveries

Measuring recovery using the ultimate rate observed at emergence from bankruptcy may be conceptually desirable, but modelling it is difficult. Craig Friedman and Sven Sandow tackle the problem by maximising the creditor’s utility function, constructed…