Risk magazine - Sep 2020

Welcome to the online edition of Risk September.

Articles in this issue

XVA traders have no time to rest on laurels

Markets have calmed, but they may not be out of the woods yet

SOFR basis blows out amid CCP discounting changes

Rate cuts may have exacerbated discount risk as basis swap opt-outs move deeply in-the-money

SocGen mulls sale of structured product books after big losses

Rival Natixis also plans to place parts of its equity derivatives business in run-off mode

New Tradeweb/IBA benchmark tipped as ‘competitor’ to SOFR

Forward-looking risk-free rate aimed at US mortgage market could have broader applications

Stanford’s Duffie shakes up SOFR credit race with AXI index

Academics propose new credit index that ditches Libor tenors for a single funding spread

After Covid, CCPs face calls for revamped disclosures

Banks and buy-side firms working with clearers to provide more granular info on margin shortfalls

Ronin, felled prop giant, shuts up shop

Firm cancels regulatory licences; traders receiving payouts on equity stakes

Fed’s approach to stressing op risk frustrates banks

Regulator’s stress test results overshoot banks’ numbers, threatening capital plans

People moves: Huey Evans joins IHS Markit board, new tech risk head at HKeX, and more

Latest job changes across the industry

The changing shape of buy-side risk technology

Buy-side risk managers and FactSet’s global head of quantitative analytics gathered for a Risk.net webinar to discuss topical risk management trends for asset managers and to consider the industry challenges posed by the recent Covid‑19 pandemic

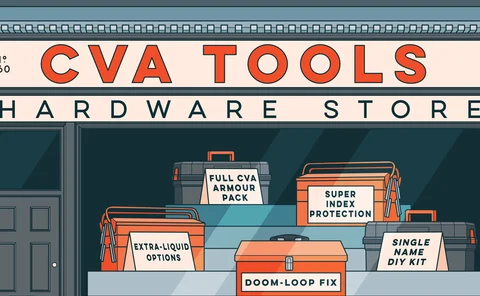

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

Inside the Fed’s secret liquidity stress tests

Lobbyists and Quarles train sights on horizontal exams that can shape bank risk appetite

Mega-hedges and generational strife at PGGM

Buy-side risk survey: for Dutch pension giant, battle between young and old shaped response to March mayhem

Managing AML and fraud – A risky business needs a risk-based approach

Financial services organisations (FSOs) are expected to meet strict financial crime regulations regardless of their size, and those with smaller budgets and fewer resources are finding this increasingly difficult as regulations, guidelines and threats…

Quant finance courses tested by Covid’s echoing classrooms

Universities fret over drop in international students and demands of online learning

The unintended impact of swap stays on financial stability

As swaps leverage shrinks, bankruptcy stay rules are not guaranteed to reduce systemic risk, says economist

Moonshots shelved: banks spend on home-working tech

Dealers made success of remote working switch – now they’re investing in its future, and pausing grander ambitions

Race to cash in on term Sonia is filled with twists

Pending merger and FCA’s effort to create synthetic Libor rates could sway outcome

Rival SOFR conventions splinter loan market

Diverging approaches to calculating interest payments sow uncertainty and hedging concerns

FX swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

EBA’s software compromise draws fire on two fronts

UK regulator suggests it will neuter the proposed capital relief, which banks say doesn’t go far enough

CFTC block trade plan gets cold shoulder

Industry divided over swaps reform proposal, and advisory committee casts doubt on need for it

EU hands CCP members a narrow win on skin in the game

Clearing members could use the final rules to push for higher CCP capital globally

Funds turn to stress-testing in fast-forward and reverse

Buy-side risk survey: Covid-19 is changing the way investors think about stress tests

How UBS AM dealt with Covid-19 crunch

Buy-side risk survey: Swiss giant had planned for liquidity squeeze, says CRO – but not one like March

The long-term effect of Covid-19 on market risk capital

Covid-19 has replaced the global financial crisis in some banks’ stressed VAR calculations

Internal stress tests of EU banks not up to scratch – ECB

Only one in 10 banks’ internal tests are tougher than supervisor-run programmes

Systemic US banks’ leverage exposures shrank $1.4tn in Q2

On-balance sheet exposures fall on Fed relief

Top banks defer €1.6bn of profits on hard-to-value trades in H1

BNP Paribas set aside €532 million alone in H1

Tougher OTC trading conditions to persist, say European banks

Seventy-three per cent of respondents expect tight price and non-price terms through September

Deposit flows shape systemic US banks’ liquidity risk

Non-operational deposits accounted for over 25% of cash outflows in Q2

Fed dollar swap operations slow as funding strains ease

Seven-day swap utilisation has dropped off since May

To make sense of complex systems, send in the agents

Standard quant models cannot comprehend a radically complex reality, writes Jean-Phillippe Bouchaud

Time to move on from mean-variance diversification

A new diversification measure appears to produce better results than mean-variance optimisation

Equally diversified or equally weighted?

New diversification measure enables construction of equally diversified portfolios

Benchmark reform goes non-linear

Terminating Libor will bring great challenges to the pricing of non-linear rate products

The data anonymiser

Non-parametric approaches anonymise datasets while reproducing their statistical properties

For a post-Covid world, quant fund revives a contentious idea

Crisis puts out-of-vogue practice of “porting” alpha back in play