Risk magazine - Oct 2021

Articles in this issue

Citi reorg the final note in failed swaps clearing model

Strategic shift from OTC clearing powerhouse to client support function marks the end of an era

BSBY swap fallbacks too flimsy for BMR – FCA

Pressure piles on SOFR alternative as US, UK regulators axe their role in Isda replacement waterfall

EU banks aim to block new counterparty risk guidance

Requirement to include exposure spikes linked to swap payments within EEPE models prompts blowback

Synthetic Libor gets cautious approval as swaps fix

‘Tough legacy’ solution could mop up $2.7trn-equivalent of non-cleared sterling and yen derivatives

BlackRock to grant funds power to track climate risks

Aladdin system holding trillions of dollars to show whether funds are burning the Earth or saving it

EBA set to unveil revised hybrid stress-test framework

Firms fear new bank-run leg in 2023 exam could prove an operational headache

EC shelves report on relocation of euro clearing

Consultation revealed a deep reluctance among banks to shift clearing to EU CCPs

People moves: Citi nabs JPM and Citadel staff, and more

Latest job changes across the industry

Clear out: inside the equities takeover of Citi’s FCM

Clearing unit is being reshaped to support equities growth push

After Archegos, a bigger role for XVA desks?

Credit Suisse has stalled on call to expand XVA remit; others think it would have helped, but disagree on how

Cyber optics: are banks downplaying SolarWinds hack?

In wake of watershed breach, banks eye supply chain risk while talking down hack’s impact

Phase five margin queues spur calls for custody revamp

Custodians urged to update “antiquated technology” ahead of three-fold jump in phase six initial margin onboarding

Why new EU rules are fuelling greenwashing and how to stop it

Reporting requirements for ESG funds may not solve the problem – a list of harmful investments might

From the margins: CGBs vie to join the collateral club

Can CGBs emulate US Treasuries as initial margin on cross-border derivatives trades?

EC expected to apply output floor at group level only

‘Parallel stacks’ proposal unlikely to appear in first draft of CRR III, due next month

Currenex case may herald focus on e-FX’s ‘Wild West’ days

FX sources say “uncomfortable secrets” could emerge as attention turns to platform relationships

Don’t bank on it: Fed urged to widen access to new repo facility

Central clearing of SRF’s repos and less unease over its use could also buoy glitchy Treasury market

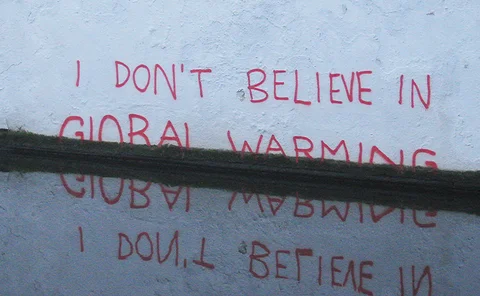

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

NSCC caught $5 billion short in June

Worst-case losses would have wiped out the CCP’s available liquid resources on two separate days in Q2

European banks set for 17.6% capital hike under Basel III

Output floor expected to push Tier 1 capital requirements up 7.3% alone, latest BCBS monitoring report shows

BNP Paribas leads EU banks on repo exposures

French bank increased securities financing transactions by €66bn in the first half of the year, the most among the bloc’s top lenders

Systemic US banks’ bail-in buffers rose in Q2

Morgan Stanley posts largest amount of headroom, while Citi, State Street and Wells Fargo trail behind

StanChart’s CVA charge up 19% in Q2

Higher capital requirements also at Barclays, Lloyds and NatWest, with HSBC the only outlier among top UK banks

Sonia/SOFR swaps jump ahead of ‘RFR First’ initiative

Cross-currency swaps increasingly seeing RFRs on both legs

An ‘optimal’ way to calculate future P&L distributions?

Quants use neural networks to upgrade classic options pricing model

Deep learning profit and loss

The P&L distribution of a complex derivatives portfolio is computed via deep learning

Axes that matter: PCA with a difference

Differential PCA is introduced to reduce the dimensionality in derivative pricing problems

A quant’s view on protecting stock-pickers from themselves

Ex-Citadel, Millennium risk manager says fundamental investors have much still to improve