Risk magazine - Jul 2020

Articles in this issue

Applying the scientific method to investing

The new field of experimental finance goes beyond backtesting

Libor death notice could be served this year – FCA

Announcement may come soon after Isda’s fallback protocol takes effect in November

Shifting Libor fallback window jolts basis market

Fallback spreads widened more than 20% after UK regulator says Libor’s end could be announced this year

Risk-free rates may fail liquidity test for hedge accounting

Experts fear trades referencing SOFR and €STR will not be eligible for hedging relief

Libor trap lurks in 2021 US stress tests

Using SOFR, borrowing could boom and revenues collapse

Recent defaults lead to record credit derivatives payouts

CDS auctions have yielded historically low recovery rates this year, meaning swap sellers have had to pay more than normal

Bond-CDS basis keeps investors interested

Difference between cash bond spreads and derivatives tightens but still offers value, dealers say

Data error inflated Wells Fargo’s op risk capital by $5 billion

Sharp fall in Q1 RWAs followed removal of duplicate data

US banks face capital hit from resurgent advanced approaches

Banks pushed onto internal models wrestle with procyclical capital charges

Banks push for capital changes as CECL provisions soar

Spike in set-asides exposes fault lines between new accounting standards and Basel rules

Banks eye post-pandemic shake-up of op risk scenarios

Firms seek better handle on impact of global shocks, and hope to avert regulatory attention

People moves: Citi clearing head Kemp retires, Sapcanin made CRO of European markets, HSBC GAM hires Axa’s Leon, and more

Latest job changes across the industry

Covid-19: Pandemic risk – Special report 2020

The economic devastation wrought by Covid-19 is already significant: the hits to employment, gross domestic product and other key macro factors regulators ask banks to test to has already surpassed supervisors’ severely adverse scenarios, and shows every…

The scientists probing the human mind for an investing edge

Recent advances in behavioural finance could give rise to new quant models and strategies

Credit problem: SOFR faces uphill struggle in loan market

Furnishing Libor’s replacement with a credit-sensitive spread is proving to be a Sisyphean task

Clearing banks feel pinch as rates turn negative

Negative returns on dollar deposits at Eurex, Ice and LCH spur talk of business model change

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Conduct risks stalk banks in Libor transition

As replacement rate concerns become more pressing, firms fear Libor lawsuits and regulatory wrath

Initial margin – Special report 2020

Buy-side firms in advanced preparations for phases five and six of initial margin (IM) rules are eager to maintain momentum and put their efforts to the test now that implementation has been delayed by 12 months following disruptions related to the Covid…

Eurex’s risk chief on the need for boring models

Banks need stability and predictability of VAR-based margin when volatility spikes, says clearing house CRO

Rise of ethical swaps brings hedging questions

Banks ponder how to offset risks of ESG derivatives – or whether hedging is even desirable

Bruised, not broken: execs say Libor switch on track despite Covid

Compressed timeline for transition may leave smaller firms struggling to meet end-2021 deadline

Beware of cliff edge in Libor fallbacks

Derivatives users may see a sudden change in the value of payoffs when Libor ends, Coremont analysts write

Key steps in the transition to SOFR

Phil Whitehurst, head of service development, rates, SwapClear at LCH, offers his insight into when a term structure for the secured overnight financing rate (SOFR) is likely to be established, what will be required for this to become a reality and what…

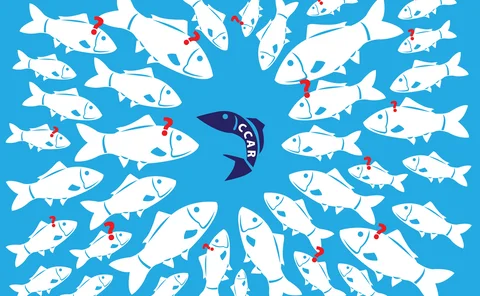

How the Fed’s Covid stress test got stuck in the middle

Experts fear CCAR add-on has neither informed investors nor guided capital management

Synthetics sweetener teases European banks

As structural woes resolve, regulators remain split on preferential capital treatment for STS deals

Investors at the gates: MMF reforms fail the Covid test

After MMF rescues return, regulators urged to rethink rules on gates and sponsor support

Confidence in pricing data is essential in a distressed market

Jason Waight, head of regulatory affairs, Europe at MarketAxess, explores the key role of reliable data sources in offering a commercial advantage to traders during the March crisis

Scared of fallen angels? So are the rating agencies

Data shows rating agencies more reluctant to downgrade firms at the investment-grade boundary

Quant firm deploys new metric for Covid sensitivity

Los Angeles Capital debuts new factor for measuring stocks’ sensitivity to the pandemic

Sometimes it’s fine to be boring

Diversification puts portfolios in the middle of the pack – where investors feel safe, writes Antonia Lim

Driving anti-money laundering efficiency gains using artificial intelligence

Anti-money laundering (AML) is expensive and labour-intensive, and artificial intelligence (AI) can offer improved efficiency gains. Could they be a match made in heaven? This Risk.net webinar, in association with NICE Actimize, took place amid the…

Power surge: the evolution of PPAs

Energy industry expert looks at key developments in the power purchase agreements market

Clearing banks show they’ve learned lessons of the past

CCP members were able to meet massive margin calls in March. But could they do it again?

Covid shock could topple US insurers’ exotic CLOs

Losses on “atypical” tranches could hit $899 million

Foreign banks and Fed at odds on stress test impacts

HSBC North America predicted a loan-loss rate of 2.7%, well below the Fed’s 6% estimate

Fourteen margin breaches at CME’s swap unit in Q1

The peak breach was almost $80 million in size

SwapClear incurred a $558m margin breach in Q1

Liquidity and concentration add-ons covered 41% of mark-to-market exposure

Fed’s Covid scenarios far harsher than latest stress tests

Under worst-case, 25% of banks would have post-stress CET1 ratios of less than 4.8%

Three systemic US banks face stress capital buffer add-ons

JP Morgan, Goldman Sachs, Morgan Stanley will see minimum requirements increase under new regime

Op risk data: Morgan Stanley falls foul of Dutch tax office

Also: JP Morgan settles crypto fees class action; banks debate Covid-19 scenarios. Data by ORX News

Mind the tax when hedging TRS

New model gauges whether deals are still profitable, after taxes

Funding adjustments in equity linear products

How tax asymmetries and Tobin tax affect the pricing of total return swaps

A closed-form solution for optimal mean-reverting strategies

The heat potentials method is used to find the optimal profit-taking and stop-loss levels

Doyne Farmer’s next big adventure: capturing the universe

Quant fund pioneer plans to build an economic super-simulator on a global scale