Federal Deposit Insurance Corporation (FDIC)

Debate erupts over bitcoin’s US reg status

Commodity, currency or security? Experts question cryptocurrency’s asset class after El Salvador move

New Fed regulation head unlikely to roll back all Trump changes

Progressives see climate and crypto as priorities over toughening Volcker Rule or tailoring

Loan markets call for clarity on scope of US Libor ban

Regulators must address “grey areas” in uncommitted facilities, urge participants

US watchdogs seek to govern bank AML systems as models

Banks fear prudential agencies’ move could hamper their own ability to fight financial crime

US markets fret over ‘unrepresentative’ fallbacks

Two-year gap between spread fixing and cessation leaves fallback signatories tied to outdated basis

US regulators seek to tighten cyber incident reporting

New federal rule, mindful of Covid, will force firms to report serious incidents within 36 hours

Foreign branches in US fear extension of liquidity rules

Democrat administration could revive plans to impose LCR, NSFR on branches and agencies

Softer US NSFR could skew global repo pricing

US banks benefit from Treasury repo exemption, while EU banks report only end-quarter ratios

Final NSFR rule unlocks subsidiary funding for US banks

Technical clarification allows subsidiary capital to be assigned as funding for consolidated group

Dollar Libor reprieve sparks fallback uncertainty

Popular settings to end in June 2023; market seeks clarity over timing of fallback spread triggers

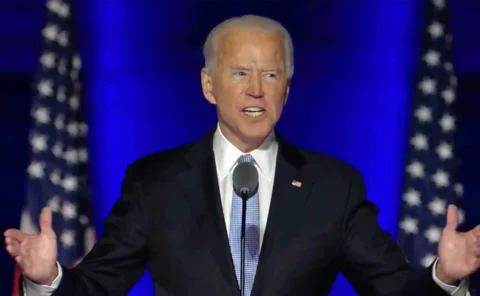

Joe Biden’s slow road to remaking US financial regulation

Moves on climate risk could come early; other changes may have to wait until end of 2021, or later

OCC warns on cyber and fraud control lapses during Covid

OpRisk North America: Covid-induced changes in operations and working practices creating openings for bad actors, says senior regulator

Now is not the time to change the rules on CCP resolution

FSB overstepping brief by putting CCP operators’ equity on the hook in resolution, writes former CFTC chair

A zombie US capital ratio comes back to life

SLR rollback could mark the return of 1990s Tier 1 leverage ratio as a binding constraint

How regional banks could shape US Libor replacement

Regulators convene working group to address credit sensitivity concerns

Fed missed chance to curb dividends, say ex-supervisors

Instead, changes to stress capital buffer and TLAC rules would allow larger payouts

Central banks activate contingency plans amid pandemic

Rotating and remote team working aims to reduce contagion risk

EU banks rue SA-CCR mismatch with US

European clearers are stuck with CEM until 2021, but some US banks are reluctant to switch early

US banks anticipate fresh guidance on resolution liquidity

Consultation in first half of 2020 expected to clarify intra-group and forecasting requirements

US branches of foreign banks shed $91 billion of reserves in 2018

Drop-off coincides with Fed’s ‘normalisation’ strategy

SA-CCR may need more fundamental fixes

Quants propose tweaks to improve Basel counterparty credit risk framework

US version of SA-CCR could hurt settled-to-market swaps

Capital requirements on a client’s hedged options portfolio could increase by 1,100%

Unmoved, Fed stands by G-Sib surcharge

Facing down frenetic lobbying and even US Treasury, central bank doesn’t blink on surcharge

Regulators rethink Volcker overhaul to solve accounting glitch

Bankers urge cancellation of new definition of prop trades that could capture liquidity buffers