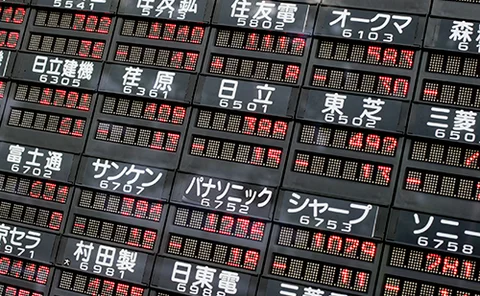

Bank of Japan (BoJ)

Hedge funds cut BoJ bets after torrid year in yen rates

Dealers see lighter positioning after shock October election saw more than $300m of losses, compounding April’s pain

Japan Post Bank’s liquid deposits reach largest ever share

A decade since its privatisation, the bank has seen a shift in its deposit structure

Margin breaches skyrocket at JSCC amid market volatility

August turmoil led to record initial margin shortfalls at six clearing divisions

Markdowns on Japan Post Bank’s domestic bonds widen 50%

Unrealised losses on JGBs-dominated book compounded by out-of-the-money foreign-bond hedges

Dealers bruised by surprise renminbi vol surge

Rush to re-hedge USD/CNH exotics left banks in grip of painful short gamma squeeze

Traders flipped long yen vol ahead of market rout

Hedge funds and real money bought long yen volatility in the run-up to Monday’s turmoil

Are market-makers better at dealing with central bank intervention?

Lack of pain following BoJ intervention suggests dealers are better at handling event risk

Buy side looks to fill talent gap in yen rates trading

Isda AGM: Japan rate rises spark demand for traders; dealers say inexperience could trigger volatility

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

Japanese banks’ leverage ratios keep rising as BoJ relief becomes permanent

Norinchukin reaps largest benefit on eve of Covid-19-era exemption being made permanent

Foreign buyers jolt e-trading in Japan government bonds

Platforms report rise in small-ticket volumes, but bigger trades remain on voice

Japan’s interest rate derivatives trading and clearing on the rise

Japan Exchange Group and OpenGamma chart Japan’s journey towards a flourishing derivatives trading and clearing ecosystem

Managing Japanese interest rate risk and creating trading opportunities

With an anticipated rise in Japanese interest rates, 3-Month TONA Futures have attracted the interest of investors worldwide since debuting on the Osaka Exchange (OSE) in May. Kensuke Yazu, general manager for derivatives business development at OSE,…

Initial margin breaches surge at JSCC government bonds division

Sharp interest rate fluctuations triggers largest backtesting deficiency on record

Japanese banks hike BoJ deposits by 12%

Deposits at central bank hit three-year high at end-March, as lenders sought safe haven amid wider turmoil

Behnam comments fan JSCC hopes for US client clearing

Japan clearing exec welcomes CFTC chair’s pledge to keep discussing OTC clearing status for non-US houses

Hedge funds push yen options bets to next BoJ meeting

Target shifts as vol punts on change to rates policy fall flat

FSB: third of climate stress tests not tackling physical risk

Six jurisdictions conducted exercises only for transition risk

LCH Japan plan signals new fight for global clearing model

UK-based clearing house faces “uphill struggle” against JFSA location policy on yen derivatives

Japan dealers’ derivatives exposures keep inflating

MUFG, SMFG and SMTH added almost ¥6 trillion to their balance sheets in the three months to end-September

Launch of Tona futures ‘could bolster yen term risk-free rate’

New Tokyo Overnight Average products could be used in TORF waterfall, says benchmark provider