This article was paid for by a contributing third party.More Information.

Japan’s interest rate derivatives trading and clearing on the rise

Japan Exchange Group (JPX) and OpenGamma chart Japan’s journey towards a flourishing derivatives trading and clearing ecosystem

The Osaka Exchange (OSE), part of JPX, is a premier venue for listed interest rate derivatives trading in Japan, featuring flagship products, such as the widely traded 10-year Japanese government bond (JGB) futures and the 3-Month Tokyo overnight average rate (Tona) Futures, introduced in May 2023. Driven by expectations surrounding changes in the Bank of Japan’s (BoJ’s) monetary policy, the market has experienced noteworthy expansion, drawing keen interest from domestic and global investors.

The Japan Securities Clearing Corporation (JSCC), Japan’s leading clearing house under JPX, began clearing interest rate swaps in 2012 and now clears 70% of Japanese yen-cleared swap trades. It began offering cross-margining with exchange-traded derivatives (ETDs) in 2015. This has now been extended to include Tona futures traded at OSE, which means short- and long-term interest rate products are covered in ETDs. For offsetting portfolios, this can offer initial margin (IM) savings of up to 80%.

Japan’s listed interest rate derivatives

Japan’s primary listed interest rate derivatives are transacted on OSE, with 10-year JGB futures the pre-eminent product among global participants. Fuelled by significant trading activity and driven by considerable price volatility stemming from the expectations surrounding changes in the BoJ’s monetary policy, the daily average trading volume for 10-year JGB futures reached more than 38,000 contracts – or JPY5.7 trillion (approximately $40.3 billion notional) – in 2023. Notably, the open interest at the end of 2023 surged to JPY19.2 trillion (approximately $135.8 billion), marking a substantial 48% increase compared with the end of 2022.

Following the permanent suspension of JPY Libor publication at the end of December 2021, the majority of JPY over-the-counter (OTC) interest rate swaps shifted to Tona-based transactions.

In May 2023, OSE launched short-term interest rate derivatives, 3-Month TONA Futures, aimed at equipping investors with a valuable instrument for hedging in anticipation of the BoJ’s normalisation process on its policy rate. The daily average trading volume experienced a notable surge, reaching 6,307 contracts in January 2024. Furthermore, open interest has hovered consistently around the 20,000 contracts mark since September 2023, a trend predominantly driven by global investors – including swaps traders, market-makers and hedge funds – particularly those engaged in global macro strategies and relative-value trading.

OSE’s interest rate derivatives market offers full accessibility to offshore investors, supported by globally recognised trading infrastructure and clearing services offered by JSCC. Consequently, international participants can seamlessly access the market via prominent global clearing brokers. In 2023, offshore investors commanded a 73% share of the trading volume for 10-year JGB futures, emphasising their considerable presence and impact within the market.

JSCC offering

Since JSCC’s initial licensing in 2003, the range of services provided and products cleared – as well as recognition by foreign regulators – has expanded, with highlights including the launch of OTC interest rate swaps clearing in 2012 and the takeover of the clearing of OSE-listed derivatives in 2013.

Cleared products

As a central counterparty (CCP), JSCC provides clearing services globally for JPY-based products across four business lines, each responsible for a different product type:

- Exchange-listed products (cash and derivatives)

- Credit default swaps

- Interest rate swaps (IRS)

- OTC JGB transactions

The IRS market

JSCC began clearing IRS in 2012 and has worked to expand the products, maturities and indexes supported. It now clears:

- Basic IRS fix-float

- Basis swap – tenor swaps

- Basis swap – curve swaps

For each of these, the maturities eligible for clearing are dependent on the interest rate curve:

- Up to 40 years for overnight index swaps (OIS)

- Up to 30 years for JPY-Tokyo interbank offered rate (Tibor)

- Up to 30 years for JPY-Euroyen Tibor

JSCC’s IRS market has grown consistently in recent years, hitting a record high of JPY2,012 trillion in 2023 – almost double that of 2022. This rise was driven by a surge in the volume of shorter tenors (less than two years), which were up around 250% based on the previous year.

This growth has been sustained by increasing interest from domestic and global investors in Japanese interest rate markets. Although BoJ still has a negative rate policy in place, it allowed for higher interest rates at its monetary policy meetings in July and October 2023, stating that it would lift its policy rate after seeing steady growth in the Japanese economy in 2024.

This proposed change in policy is an incentive to investors worldwide and drove 15 new customers to onboard at JSCC in 2023, and four so far in 2024, meaning there are now 117 firms registered for the JSCC IRS market, composed of 62% domestic and 38% global firms. This diversification is driving more customers to JSCC, which now clears around 70% of the JPY IRS market.

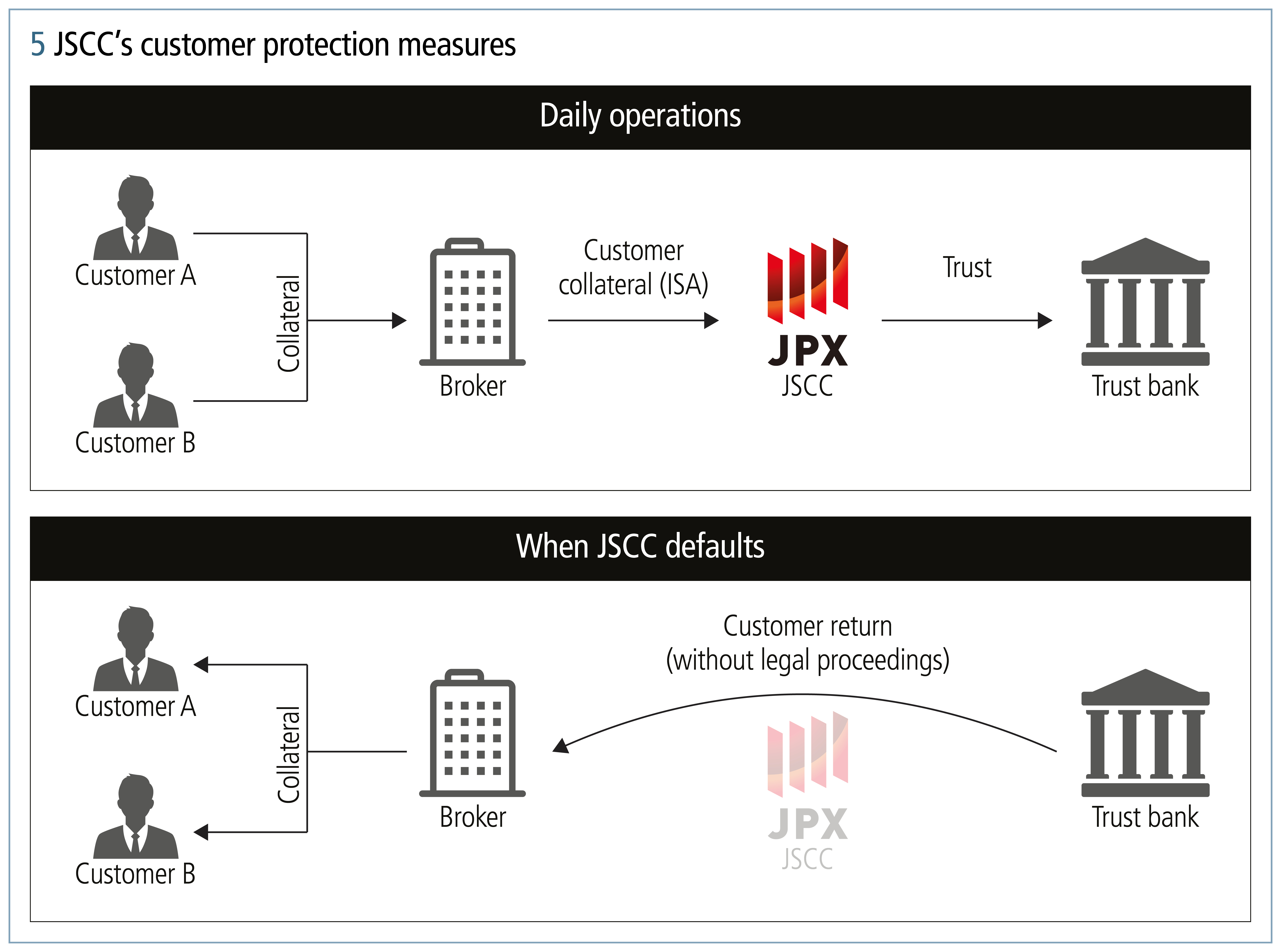

Customer segregation

The JSCC IRS market is distinguished by its rigorous customer protections. An individual segregated account (ISA) model is in place, where all customers’ collateral is secured under accounts in customers’ own names and isolated from any clearing broker default. The ISA, which does not bear any fellow-customer risk, is the most stringent framework of all the segregation models – including gross omnibus segregated accounts or legally segregated, operationally commingled accounts.

JSCC has two further measures that reinforce customer protections:

- All collateral is deposited at a trust bank, where it is legally safeguarded and would be returned directly to the beneficial owner following any JSCC default, without the need for any legal proceedings. Alternatively, the clearing broker may choose to use JSCC’s account with BoJ for the custody of cash collateral to avoid trust costs in relation to JPY’s negative rate.

- JSCC requires its clearing broker to deliver all customer funds to JSCC without delay, resulting in the significantly reduced risk of a clearing broker going into default while holding customer funds in its own account.

JSCC has recently enhanced its already rigorous framework by adding measures to make it easier for customers wishing to clear JPY IRS at JSCC:

- Institutional customers executing JPY swaps on Tradeweb Markets’ multilateral trading facilities (MTFs) and swap execution facilities (SEFs) can now clear transactions via JSCC. This followed JSCC’s decision to support MTF and SEF trading, allowing fully automated workflows – from pre-trade credit checks to execution and clearing – to achieve straight-through processing, replacing the previous confirmation process between clearing houses and clearing brokers subsequent to the execution of their customers’ JPY swap transactions.

- JSCC has enhanced its customer buffer to reduce the possibility of trades being rejected for clearing, and has introduced a new allowance of JPY1 billion ($7 million) per clearing broker to cover the shortfall in margin prefunding to clear new trade in its proprietary or customer accounts. The customer buffer framework allocates the collateral posted by a clearing broker in advance (customer buffer) as required to cover a shortfall in a customer’s collateral to cover margin requirements on new transactions.

Cross-margining

In addition to rigorous customer protections, JSCC supports effective margin management through its cross-margining offering.

JSCC introduced offsets between 10-year JGB futures and IRS in 2015, allowing customers clearing both products (and with opposite exposures) to reduce IM requirements. To further enhance the benefits for customers, JSCC has expanded the scope to include OSE’s 3-Month TONA Futures.

JSCC’s cross-margining service now covers short-term rates with Tona futures, long-term rates with 10-year JGB futures and the full curve with IRS. Effective and optimised IM is now available for JPY rate products.

Based on provisional calculations using a sample portfolio, customers trading these three products can save around 80% of their IM requirements. This improvement will help investors increase returns and will make JSCC’s IRS clearing service even more attractive to the JPY IRS market.

The following section looks at the differences between JSCC and other CCPs for IRS clearing, explores the features of the cross-margining offerings in the interest rate market and analyses the IM savings that can be achieved based on a range of portfolios.

How JSCC compares with other markets

JSCC’s fixed income clearing services offer two main areas of solutions to customers: the clearing of JPY IRS and the cross-margining of these trades with ETDs.

IRS clearing

The way margins are calculated with JSCC is similar to that used by other CCPs in that the main component is based on filtered historical simulation, which is then supplemented by a number of add-ons to cover specific risks – for example, liquidity and credit risk. However, there are key differences between methodologies that can result in opportunities for optimising margin requirements depending on the portfolio.

JSCC margin is calculated using historical simulation (expected shortfall) to cover the risks from interest rate fluctuations.

Other CCPs also use historical simulation but vary on whether they use expected shortfall or value-at-risk (VAR) to determine potential losses. There are also differences in the curves used, and the way they are constructed, that can impact margin requirements.

The exponentially weighted moving average (EWMA) is used by JSCC and other CCPs to scale historical scenarios to be in line with current volatility. However, the way it is applied and the parameters used will vary, resulting in different historical scenarios.

Most models include stress scenarios within their algorithms but take a completely different approach to how these are included.

JSCC incorporates stress events within the expected shortfall calculation. The difference from standard scenarios is that EWMA scaling is not applied to these, meaning the actual interest moves seen for these events will be applied.

Other CCPs might, for example, calculate a separate VAR using specific stress events or a longer lookback period, a higher confidence level and no volatility scaling. The difference between this and the base margin is then applied as an add-on to the total margin, or a maximum of the two values is taken as the base margin.

Regulation requires that a minimum confidence level of 99.5% is used in margin calculations. JSCC uses this level, but some other CCPs are known to calculate margin at a slightly higher confidence level.

JSCC uses 1,250 historical scenarios as well as additional stress scenarios. Other CCPs may use more or fewer scenarios, for example, a 10-year lookback period that equates to around 2,500 scenarios.

For the holding period, most CCPs use the same values: this is five days for house accounts and seven days for customer accounts (to account for the time taken to manage customers’ porting requests).

All CCPs include add-ons to cover specific risks. A liquidity add-on is common to many algorithms and is used by JSCC to cover the cost of managing larger positions following a default. Although implemented differently, the CCP liquidity add-ons all consider the costs of hedging a portfolio using standard swaps.

Other add-ons can be tailored to specific aspects of the risk management of the CCP, although they cover common risks, such as credit risk.

A specific example is a sovereign risk add-on. The default could be to calculate margin and request collateral in the currency of the CCP. However, for a participant trading mainly in another currency and using matching collateral, this introduces risk based on the mismatch for which the CCP would require additional margin.

JSCC is now the leading clearer of JPY IRS, covering around 70% of the market based on average monthly volume. The proportion of trades cleared in Japan has risen steadily since the cessation of JPY Libor in 2021, and this increase is expected to continue.

This rise has mostly been in the dealer clearing business, with JSCC now accounting for almost all of this market by monthly volume globally. LCH is still the majority clearer for customer trades.

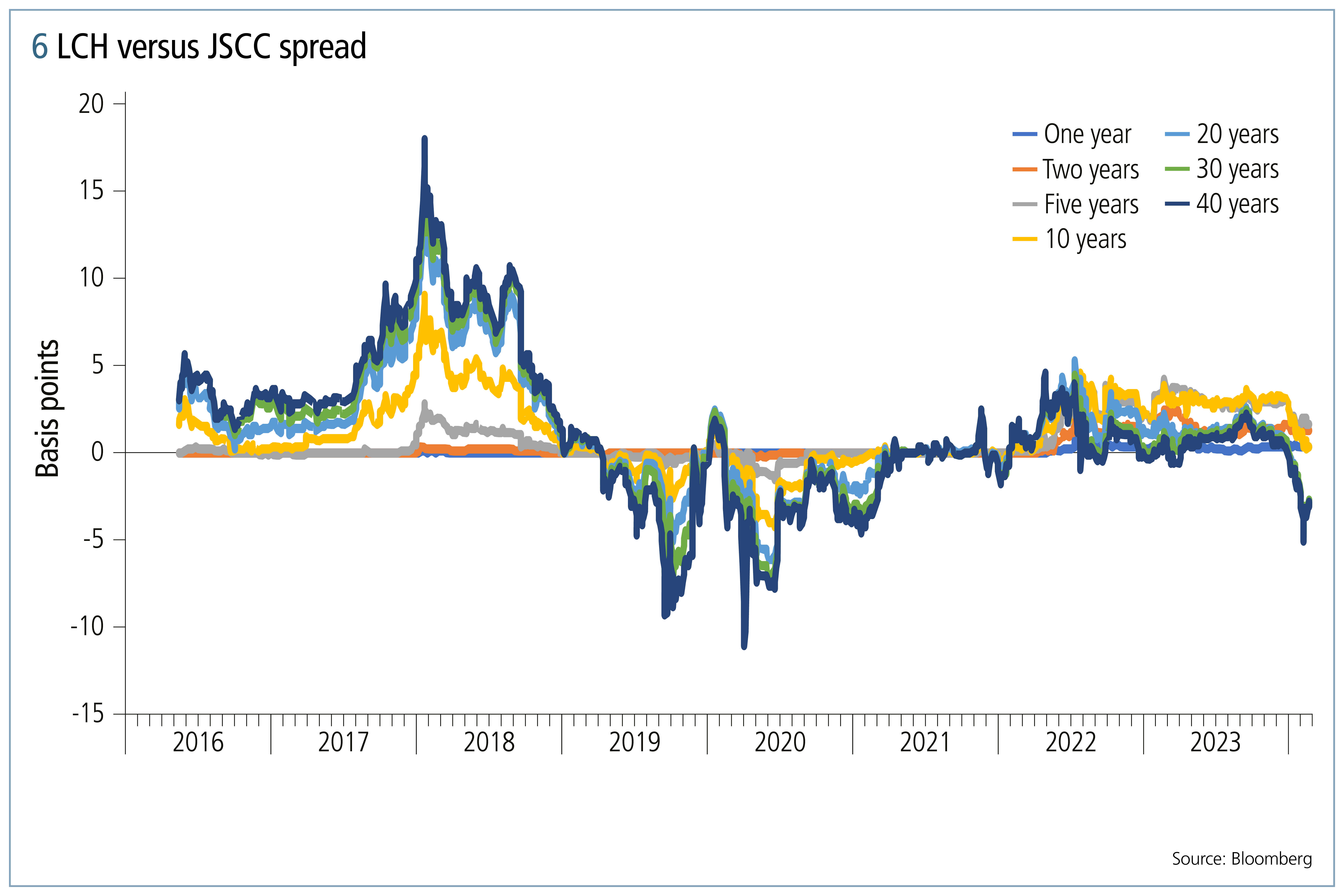

This multi-CCP liquidity offers the possibility of choosing a CCP to optimise margin. In addition, the CCP price spread due to the differing expectations on future rates by the users in each market provides arbitrage opportunities – especially for hedge funds.

In particular, the spread on long-dated JPY IRS between JSCC and LCH has recently turned negative. The rate on 20-year pay-fixed swaps at LCH is now nearly 5 basis points lower than at JSCC. Only a few months ago it was more than 2bp higher. This has been driven by the expectation that BoJ will change its negative rate policy at some point in 2024.

Cross-margining

The major CCPs that clear both OTC and exchange-traded interest rate derivatives offer cross-margining for these products, including reductions in requirements based on the reduced level of portfolio risk. However, only JSCC provides offsets for JPY-denominated products.

The cross-margining services provided by CCPs offer similar functionality:

- Calculation of portfolio level margin, including OTC positions alongside offsetting ETD trades

- Margin calculated based on a five-day (house) or seven-day (customer) holding period.

- An optimiser to determine the ETD positions to be used within the calculation, required because the move from the standard two-day holding period for ETD would increase requirements for any non-offsetting positions.

Although this functionality is the same at a high level, there are differences in the implementations that make a difference in how this facility can be integrated within existing operational processes. This is particularly true of the way any offsetting ETD positions are treated.

The JSCC cross-margining solution provides offsets between JPY IRS and ETD IRS products. Originally this was just for JGB futures, but has now been extended to include Tona short-term interest rate futures.

Cross-margining is calculated using the OTC algorithm based on historical simulation (expected shortfall).

- ETD positions to include in the calculation are preselected based on whether they offset the IRS trades.

- Scenario profits and losses for IRS and ETD are combined to calculate the base margin.

- ETD PV01 is added to the appropriate IRS bucket for calculating the liquidity add-on – for example, JGB PV01 is included in the seven-year bucket.

For some markets, the algorithm used to calculate the cross-margining requirement is the same as that used for ETD products. Here the optimisation, used to determine the positions to be included in cross-margining, can be a core part of the algorithm. A sample set of steps might be:

- Different parts of the ETD portfolio are moved in turn, in priority order, based on offsetting DV01 to be included in the OTC margin calculation.

- If this reduces the margin, then that part of the ETD portfolio remains within the OTC calculation. If not, the position is returned to the ETD calculation.

- This process is repeated until all potential offsets have been considered.

This integration of the optimisation algorithm into the margin calculation means that ETD positions can remain in the ETD account.

For other CCPs, the algorithm used to calculate cross-margining is the OTC methodology, with the process to determine the ETD positions to be included in the cross-margining calculation being a pre-step using an optimiser:

- The objective of the optimisation is to minimise portfolio risk and reduce margins by suggesting ETD positions to transfer to the IRS cross-margining programme.

- It specifies the ideal allocation of eligible interest rate products to move from a futures account to an OTC account.

Typical savings from the use of cross-margining

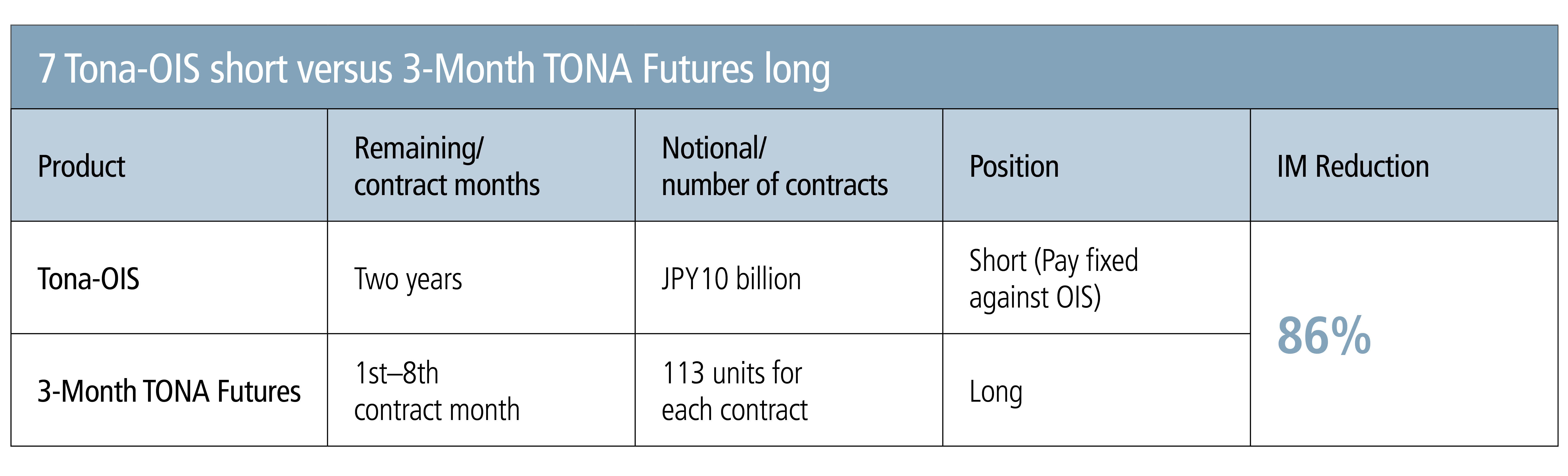

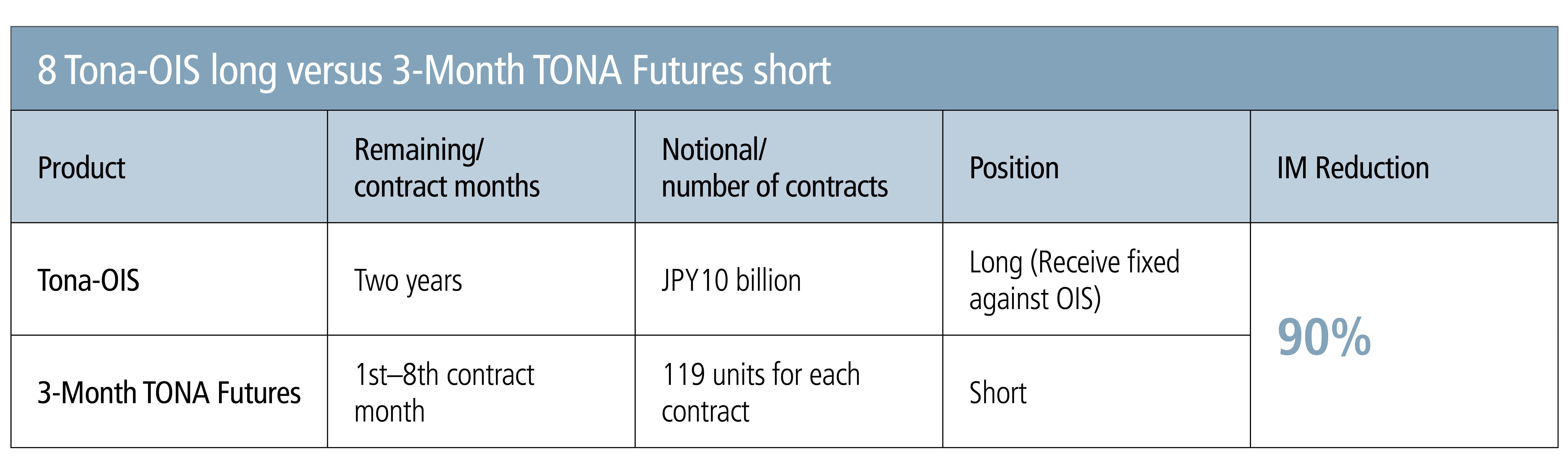

Figures 7 and 8 show sample margin savings that could be achieved based on hypothetical portfolios of Tona-OIS and 3-Month TONA Futures.

It is possible to achieve margin savings of around 80% – particularly when looking at the results for the offsetting parts of the portfolio in isolation.

Conclusion

For those wishing to trade the JPY interest rate curve, JSCC has much to offer.

JSCC is the leading market for JPY IRS, responsible for around 70% of the clearing for these products. There has been sustained growth in the market – especially the short end – with interest from domestic and global investors. The prospect of BoJ removing its negative rate policy is driving more customers to JSCC IRS, with 117 firms now registered for the service.

The addition of OSE 3-Month TONA Futures extends the range of ETDs available and, with this now being available as part of the cross-margining service, greatly increases the potential benefits. For offsets with JGB futures, IM savings of around 70% are possible. For short-dated swaps and Tona futures, savings of more than 80% are possible.

JSCC’s combination of ISA accounts and funds held in trust arrangements provides a high level of customer protection for those looking for exposure to JPY interest rate risk.

Opportunities to optimise margin – and therefore increase returns – are not always easy to identify. Knowing where to clear a particular JPY trade to minimise requirements, or which ETD positions to include within the cross-margining calculation, can be difficult to determine without the appropriate tools.

This is where solutions provided by OpenGamma can be used – the firm has access to a replicated model of the JSCC ETD-OTC cross-margining to help customers better manage their margin process.

More information

To learn more about the products and services offered by JSCC for the JPY interest rate curve, contact otc@jpx.co.jp for OTC derivatives and deri-w1@jpx.co.jp for listed derivatives.

To learn more about OpenGamma's margin optimisation solutions – including customer segregation, comparisons with other markets and potential margin savings from the use and benefits of cross-margining – contact team@opengamma.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net