Opinion

The chatbot and the quant: GPT shakes finance education

With smarter large language models, quant grads risk turning into AI-assisted slackers, writes Gordon Lee

Op risk data: Credit Suisse hit for $900m in offshore trust bust

Also: Goldman boys’ club gets the boot; HSBC double whammy; Havilland’s economic sabotage plan. Data by ORX News

A three-point turn in derivative design

Citibank quant’s triangle method allows information geometry to be applied to hedge structuring

Collateral markets in need of rewiring

New data suggests a tech upgrade is needed to avoid a large central bank footprint in markets

Swap Connect shines light on US client clearing hurdles

New scheme may intensify calls for CFTC to reassess its exempt DCO limitations

In bank runs and market crashes, it matters how ideas ‘catch’

Contagion episodes show importance of network effects in finance

Podcast: Jan Rosenzweig on fat tails and LDI portfolios

An optimised portfolio can look very different when extreme moves are given more weight

Compliance can help fintechs grow from adolescence to adulthood

It may slow US banking down, but customer safety is the difference between success and failure

Op risk data: Frank fiasco costs JP Morgan $175m

Also: Internal fraud burns fewer fingers, but flame is far from out. Data by ORX News

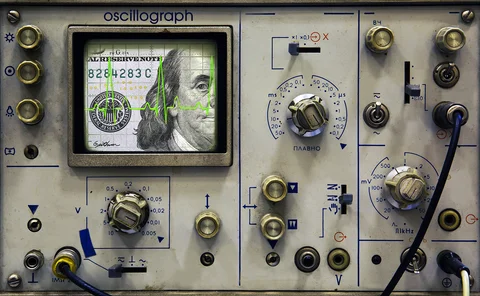

Hear no EVE, see no EVE

The Fed chastised SVB for poor rate-risk monitoring, but most US banks’ disclosures remain focused on earnings alone

Challenged single-name CDS market takes optimistic turn

Trading has boomed despite recent criticism, but can the market regain its former strength?

In a downturn, mitigation beats litigation every time

Economic shocks increase op risks for banks, but institutions can take steps to limit the danger

How banks can avoid bad haircuts on hedge fund trades

HSBC quant makes case for looking at collateral and funding rates in concert

Beyond trustless: strong governance in crypto is needed

To build trust, the crypto ecosystem can borrow proven governance principles from TradFi

Op risk data: Wells Fargo whacked for Wachovia lapse, and a Ponzi slap

Also: Long and winding road to the end of Credit Suisse; Swedbank IT fails. Data by ORX News

The Catch-22 of US banks’ liquidity buffers

US banks are using held-to-maturity bonds to underpin liquidity adequacy, grating against accounting guidance. What happens if they’re forced to sell?

After a hack, loose lips won’t sink chips

Ion Group is the latest ransomware victim to stay mum about how it was compromised. No-one benefits from this code of silence

Why US bank regulation needs a system upgrade

SVB collapse shows supervisory framework is not fit for a changing industry and new systemic risks

The win-win case for convertibles

Investors are missing a valuable source of protection against market swings, says Advent’s Daniel Partlow

Podcast: Barzykin and Guéant on FX market-making

Industry quant teams up with academics to build better risk tools for FX markets

Op risk data: Stanford fraud haunts banks for billions

Also: Helaba’s crank capital relief; TSE stock price sanction; 1MDB mauls Mudabala. Data by ORX News

Taking the measure of CMS pricing

Bank of America quants propose comprehensive framework for modelling rate derivatives

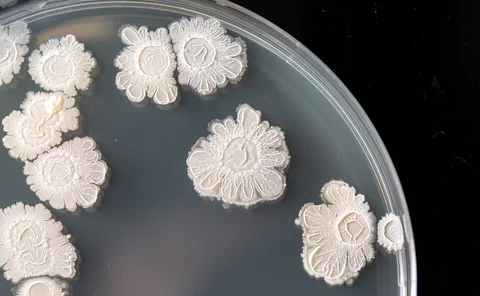

Inflationary forces (and microbial soups)

The hold of central banks over inflation may be weaker than we thought

Options liquidation can be costly. How costly?

New model uses open interest and volume data to calculate the expense of selling an options portfolio during times of stress