Opinion

Capital rules, Libor and green markets

The week on Risk.net, June 8–14, 2019

Credit data: more trouble in the oil and gas pipeline

US self-sufficiency in oil could be bad news for shale producers

Swaps data: a new era of competition in interest rate futures

The demise of Libor has set off a battle for market share in futures referencing new risk-free rates

Getting risk models runway ready

Banks struggling with internal model requirements may soon opt for off-the-rack rather than bespoke

Can European banks crack the capital allocation code?

Banks “stuck on the same feedback loop” due to sheer weight of capital rules

Libor leaders: how seven firms are tackling the transition

BMO, Prudential, Associated British Ports, LCH and others reveal their plans to move off troubled benchmark

Forex algos, Emir and quant fundamentalists

The week on Risk.net, June 1-7, 2019

Op risk data: forex rigging fines bloat bank losses

Citi, RBS, JP hit for total €800m in penalties; plus Aussie bank misconduct probe. Data by ORX News

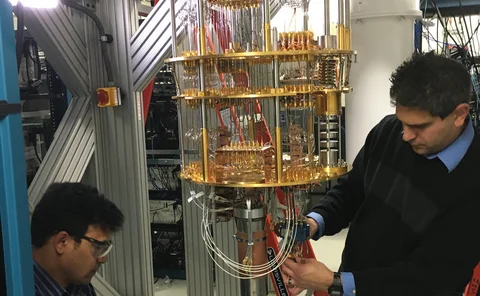

Time to put real problems to the quantum machines

There is a lot to learn before quantum computers can be applied to specific financial problems

Stock-pickers take note: the quants are coming

Quant funds are turning their hand to fundamental investing

Outsourcers, IM delay and machine learning

The week on Risk.net, May 25–31, 2019

Operational resilience means learning from failure

Firms and regulators could share data on mistakes, says Garp’s Jo Paisley

Alternative risk premia breaks through in Asia

Asian home bias and opportunity to exploit mispricing of assets among factors boosting strategies

FRTB, volatility scaling and swaps under SOFR

The week on Risk.net, May 18–24, 2019

Can bankers stop the trading book killer?

FRTB won’t obliterate your whole markets business any more, just some very specific parts

Mifid, initial margin and machine learning

The week on Risk.net, May 11–17, 2019

Not random, and not a forest: black-box ML turns white

Bayesian analysis can replace forest with a single, powerful tree, writes UBS’s Giuseppe Nuti

Burden of implementing US sanctions now firmly on energy firms

Energy firms must now screen operations of every vessel they deal with, writes maritime data expert

Fast VAR, CDS margins and Citi’s return to FX prime

The week on Risk.net, May 4–10, 2019

Whose leverage ratio is it anyway?

Basel's capital backstop has been distorted out of shape by supervisory meddling

Citi scrape could change FXPB skyline

FXPB business is in the throes of profound changes – and CCPs could benefit

Swaps data: IM grows in listed and OTC markets

Data shows fourth-quarter jump in IM across all product groups and after-effects of Nasdaq losses

Op risk data: Chinese regulators levy record fines

Also: top losses feature two frauds at Russia banks and AML provisions at Nordea. Data by ORX News

Counterparty risk, EU securitisation and Emir problems

The week on Risk.net, April 27–May 3, 2019