Operational Risk & Regulation - Volume 11/Issue 5

Articles in this issue

Where to from here?

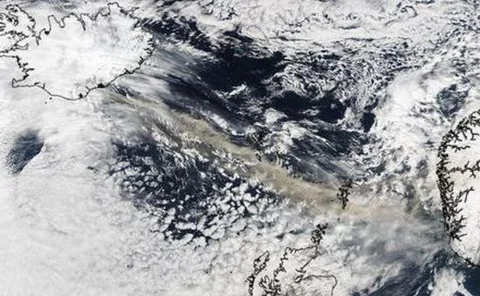

Editor Victoria Tozer-Pennington reviews the op risk events from the month that range from volcanic ash clouds to civil fraud.

Right place, right time

Eileen Robbins, vice-president in operational risk at the Depository Trust & Clearing Corporation, has a history of turning up just as things are kicking off. She talks to OR&R about the DTCC’s much-lauded handling of the Lehman Brothers collapse, and…

Action reactions

At OpRisk USA 2010 participants discussed how they can deal with increasing waves of regulation and add value in the new financial environment.

A granular approach to data

The drive for regulatory reform in the US has focused on the availabilty of data, and a bill being discussed in Washington, DC proposes the establishment of national data and research centres.

The big debate

On March 19, the European Commission hosted a high-level, intensive conference on the construction of a new crisis management framework in the banking sector. But little agreement was found among regulators, legislators and bankers.

Natural selection -- Software rankings

This year’s OR&R software survey shows that not only is operational risk management expanding way beyond its initial remit, but governance, risk and compliance is also establishing itself as a firm favourite among those looking to weather recent market…

Sound scenarios

Mariano Selvaggi describes the issues the Operational Risk Consortium took into account when preparing its report on the use of scenario analysis of operational risk in insurance, and how a sound scenarios framework can benefit firms

To boldly go

Throughout its brief history, the operational risk discipline has been labouring under a limiting and perhaps inaccurate definition of what it is and what it should be covering. Op risk needs to broaden its remit across the enterprise if it is going to…