Operational Risk & Regulation - Volume 11/Issue 12

Articles in this issue

Cebs says work on supervisory colleges is accelerating

Cebs secretary-general Arnoud Vossen, in an interview with Operational Risk & Regulation, says work on improving supervisory colleges is speeding up

Banks must keep non-execs 'up to speed' on risk, says consultancy

Protiviti head says the 'warp speed' of risk management means non-executive directors can struggle to keep up

Marco Moscadelli: The Bank of Italy man

After 20 years at Italy’s central bank, Marco Moscadelli knows his country’s banking industry well. But this hasn’t narrowed his focus, and pivotal roles on European supervisory bodies have also given him a say on how the operational risk is approached…

Reform needs broader view, says former Cesr head

Regulators need to look beyond capital structures to human issues, says Docters van Leeuwen

Basel provides guidance on the use of insurance as a mitigant

Insurance covered

IOR promotes development of KRIs in new guidance

Institute of Operational Risk says firms must use key risk indicators to assist decisions, not make them

Foreclosures failings could lead to 'second round of crisis'

Former US Senate special counsel predicts trouble for institutions struggling to foreclose mortgages

Shining a light on the flash crash

Flash cordons

Compensation: A political problem

Rulemakers are falling over themselves to introduce measures to link remuneration more closely with risk, in an effort to appease an irate public. But will their new rules work in practice, and will they have the desired effect of making compensation…

Market abuse and insider trading still seen as victimless crimes

Change of mentality needed to confront rise in insider trading says Baker Platt director

The top 10 operational risks to watch in 2011

Batten down the hatches

Suggestions of sabotage at LSE 'ridiculous' says IT consultancy

Source speculates LSE's two-hour closure in November probably due to software problems

Buckingham settles with SEC over charges of information misuse

Capital management firms settle with SEC over failing to prevent misuse of non-public information

Former Société Générale trader found guilty of HFT code theft

Samarth Agrawal on trial in Manhattan for theft of proprietary computer code from French bank

Hong Kong's SFC hands lifetime ban to jailed asset manager

Hong Kong managing director of Crown Asset Management banned from industry for life

IRS drops lawsuit against UBS on US tax evasion

UBS evades prosecution for tax evasion as US IRS drops charges

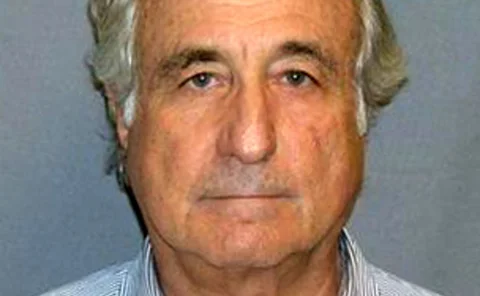

Two former Madoff employees arrested and charged with fraud

Madoff employees charged with creating false documents and trades, and misleading investors

Ghost brokers busted by UK Fraud Bureau

UK trio charged with insurance and tax fraud as well as money laundering

FSA consults on remuneration disclosure requirements

New consultancy paper from the UK FSA requires all firms to disclose their remuneration methodology under CRDIII.

Sponsored feature: The fight against financial crime – a post-crisis response

The fight against financial crime – a post-crisis response

Sponsored feature: The ultimate risk – flawed liquidity risk management

The ultimate risk – flawed liquidity risk management

A comprehensive risk and control self-assessment methodology

How to take control

Types of operational risk loss by event, October 2008 to October 2010

As in August, most losses in October fell into the ‘Clients, products and business practices’ category