News

Dexia official acquitted of alleged swaps fraud in Italy

City of Prato likely to appeal despite perjury claims

Is there still life in the low-vol bet?

Quant analysts disagree on rate sensitivity of $150 billion strategy

Council of EU holds firm to salvage STS securitisations

Market participants welcome reversion to 5% retention rate and lower penalties for breaches

New light cast on shadow bank risk

PLS-SEM model could test assumptions on shadow banks’ risk role

CFTC rules shake-up could outpace Treasury review

Giancarlo’s Project Kiss could deliver faster than Mnuchin’s four-part regulatory reform report due next month

Model risk falls under the CCAR microscope

Fed using qualitative reviews to test compliance with SR 11-7

LCH set to launch repo client clearing service

Project will allow buy-side firms to access CCP through sponsor banks in coming months

FRTB standardised approach threatens commodity hedging

Basel language would force unnatural treatment of offsetting positions

Fear of CTA sell-offs could trigger wider stampede

Trend followers could not roil markets alone, but anxiety about them might, say BAML analysts

Banks worry FRTB will fracture Asian trading desks

Rules could produce “lots of little country desks”, warns StanChart market risk head

Goldman’s veteran rates head moves to risk role

Three co-heads named after Pantazopoulos ends nine-year run at the head of rates group

BIS releases final forex code of conduct

BIS releases principles for good conduct in foreign exchange markets

Basel opts for aggregate bank capital output floor

Banks will have more flexibility on use of internal models, but calibration still undecided

Emir reporting relief for ETDs causes confusion

Market participants unsure who will report client-side leg of exchange-traded derivatives trades to CCPs

EU lawmakers consider extending FRTB deadline

European Commission policy expert says current deadline is too ambitious

Spectre of mass swap unwinds looms ahead of VM deadline

Dealers warn of market disruption if trades lacking new CSAs are terminated before September 1

Basel group said to weigh changes to key FRTB test

EC and EBA officials criticise low pass rates for P&L attribution test

Delay revised Basel capital rules, say bankers

Regulatory heads at JP Morgan and BNP Paribas recommend regulatory recess

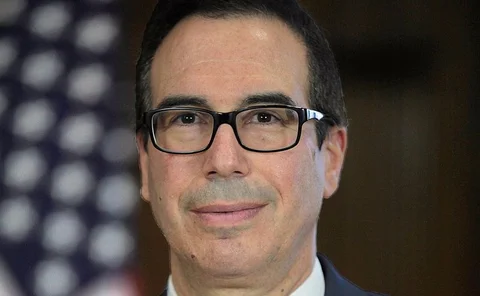

Mnuchin: new Glass-Steagall would not separate banks

US treasury secretary’s stance on banking reform appears to contrast with that of Donald Trump

People: Noble shuffles board in wake of Elman exit

Shell swaps trading chiefs; ex-Dreyfus head joins Cofco; Glencore adds Aberdeen’s Gilbert to board

Saba’s Weinstein: ETFs ‘destroy value’ in junk bonds

Hedge funds wary of high-yield bonds; blame ETFs for shrinking liquidity premium

Deutsche Börse exec backs euro clearing landgrab

Swiss CCP operator Six x-clear defends current equivalence regime

UBS to get new market risk head

Internal move sees equities risk chief replace Kasenally, after her move to UBS AM

BAML and Morgan Stanley shift Indian P-notes to Europe

Tax changes trigger move out of Mauritius and Singapore