News

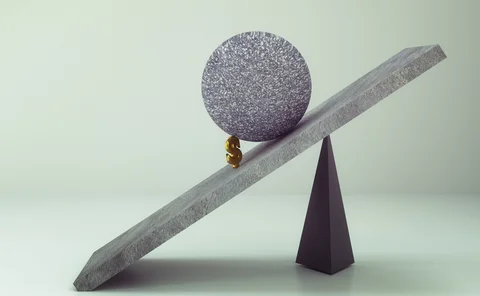

FCMs warn CCPs not to compete on margin

Equity moves in February exceeded margin posted against some cleared products

CFTC commissioners lash out at EC clearing proposal

Push to expand oversight of US CCPs is “clear breach” of 2016 equivalence deal, Quintenz says

Esma investigating Mifid trade data publishers

European regulator warns approved publication arrangements could be breaking the rules

Quants warn over flaws in machine learning predictions

Six quants debate whether the tool can adjust to paradigm shifts in financial markets

Neural network learns ‘universal model’ for stock-price moves

Relationships between order flow and price “are stable through time and across stocks and sectors”

European supervisors may step in over Priips confusion

Differences in how issuers disclose product costs harming comparability, observers say

Banks make new push on FRTB’s P&L test

Industry calls for series of changes as regulators prepare new consultation, says Nomura’s Epperlein

Don’t count on vol regime change – BlackRock quant

“This time next year volatility will most likely be low,” says Fishwick

Treasury official calls on Fed to review FBO rules

Senate bill aims to relax US Sifi threshold but offers no relief for foreign banks

Canada’s banks go it alone with FRTB data utility

Local lenders reject advances of major data utilities to build own solution

Month of higher vol spurs equity derivatives trading

Turmoil benefits total return futures, cross-asset arbitrage and dispersion

Deutsche adds senior quant to risk methodology team

Theis leaves role as head of market models at Standard Chartered to join German bank

Nikkei sell-off puts Japanese autocall dealers on alert

Risk recycling may backfire if index slump continues

Latvian bank collapse casts doubt on moratorium plan

Lobbyists say handling of ABLV shows flaws in EC’s pre-resolution stay concept

Podcast: Mercurio on Libor, fraud and writing models on a plane

Post-Libor environment and financial crime detection to drive future research, says top quant

Deutsche joins Goldman in change of FX terms

German bank offers to share price-move gains with clients

Senate bill will not hurt big bank oversight – Powell

Fed chair says raising of Sifi threshold will not affect application of enhanced standards

JSCC to aid yen Libor transition with new OIS swaps

Market participants sceptical launch will boost liquidity enough to help move off yen Libor

Global regulation vice-president leaves MetLife

End of Sifi designation court fight reduces need for legal and lobbying work at US insurer

European legislators to exempt CCPs from new bank rules

Support in Council and Parliament suggests leverage ratio, NSFR exemptions will be in final text

Swaps users face tense wait for Euribor all-clear

Euro swaps market would have a year to replace rate if it fails to comply with EU benchmark rules

QE unwind won’t spur volatility, say quants

Bond-buying schemes have “almost zero” link to volatility of stocks, says Wolfe Research

Hong Kong prepares boost to equity derivatives booking

Proposed revamp of large exposure limits would allow netting to reduce capital charges

US clearing banks still push for leverage ratio IM offset

Potential cut in ratio and adoption of SA-CCR not enough to stop shake-out, FCMs warn