Credit markets

Basel paper outlines way forward for op risk insurers

The Basel Committee on Banking Supervision released a paper in August outlining what the insurance industry must do to design op risk transfer products, including insurance and capital markets products.

Rumbles in the ratings jungle

Things are astir in the ratings jungle. Moody's published a paper earlier this year detailing a specific approach to assessing operational risk. Fitch will shortly be devoting a separate section of its rating reports to op risk. And Standard & Poor's,…

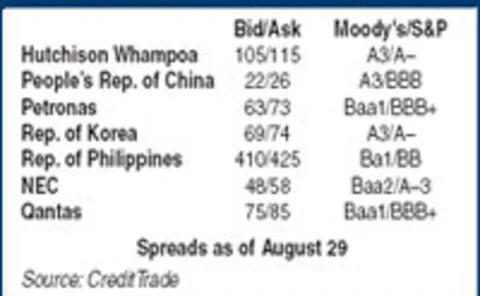

Analysing counterparty risk

In an attempt to improve on existing regulatory approaches to derivatives counterparty creditrisk, Eduardo Canabarro, Evan Picoult and Tom Wilde present a new method based on expectedpositive exposure (EPE). Using a one-factor conditional independence…

Avoiding the potholes

Whole-business securitisations

Protecting your own

Alstom

King’s new throne

People news

Sick and tired of the three per cents

High yield

Credit crunch!

Columnist

Financials: safe as houses

Credit of the month

Hedge fund tricks or treats?

Trading practices

The dilemmas of risk disclosure

Disclosure

Targeting retail investors

New angles

Calling the shots

Comment

People briefs

People

A value-added proposition

CDO managers

News in brief

New angles

A limited scope

Investment products

Rumbles in the ratings jungle

RATINGS COMMENT

Basel paper outlines way forward for op risk insurers

REGULATORY UPDATE

Regulator outlines AMA issues for US banks

SUPERVISOR'S VIEWPOINT

Reason for hope

Risk analysis

Credit due

commentary

Editor’s letter

comment