Quant investing

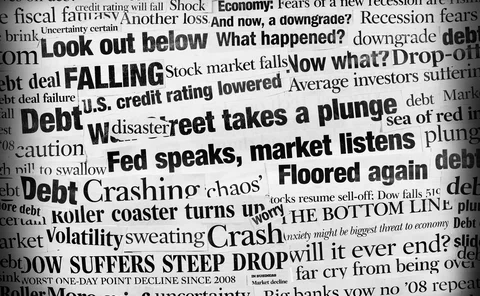

Why value’s vaccine rally left investors disappointed

Uncertainty and strategy design meant November 9 rally fell short of covering momentum crash

The value rally that never was

Many value stocks stayed flat on November 9 vaccine news, says factor investing expert

Quants worry inflation risks could sink stocks

Research from ex-BoE official Sushil Wadhwani shows stocks may struggle when inflation is high

Aaron Brown: to learn how to handle a crisis, create one

Scenario analysis still isn’t taken seriously; it should be, says AQR’s former risk chief

Quants tout alternative carry trades for the ‘new normal’

Low rates and flatlining yield curves leave investors seeking carry in swaps and swaptions

Back to school: BlackRock uses quant quake lessons on Covid

Pandemic prompts a switch in approach from strategic to tactical

Broken backtests leave quant researchers at a loss

As historical data loses relevance, quants must find new ways to validate their theories

Fund managers seek to plug holes in ESG data

Social intel proves elusive as virus reawakens sense of corporate virtue

Quants try to explain why value works better in credit

Equity value may be in the doldrums, but the strategy works in credit – investors think they know why

NYU’s Epstein on fear and complacency in the age of Covid

Pioneer of agent-based models warns of virus resurgence akin to 1918 Spanish flu

Vol decay and correlation flips: CFM’s take on the Covid crisis

Market bounce-back blindsided quant investment firm – and others

To make sense of complex systems, send in the agents

Standard quant models cannot comprehend a radically complex reality, writes Jean-Phillippe Bouchaud

For a post-Covid world, quant fund revives a contentious idea

Crisis puts out-of-vogue practice of “porting” alpha back in play

Why a top quant wants to be wrong about markets

Former Pimco quant Rebonato sees weak returns, inflation and sovereign debt troubles ahead

Quant investors turn to raw data over ratings in ESG alpha hunt

Firms are using data on product returns and employee welfare to pick winners

How adaptive models got AlphaSimplex through the Covid crisis

System sped up moves out of stocks into commodities and bonds

Applying the scientific method to investing

The new field of experimental finance goes beyond backtesting

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

The scientists probing the human mind for an investing edge

Recent advances in behavioural finance could give rise to new quant models and strategies

Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking

Sometimes it’s fine to be boring

Diversification puts portfolios in the middle of the pack – where investors feel safe, writes Antonia Lim

Quant firm deploys new metric for Covid sensitivity

Los Angeles Capital debuts new factor for measuring stocks’ sensitivity to the pandemic

Doyne Farmer’s next big adventure: capturing the universe

Quant fund pioneer plans to build an economic super-simulator on a global scale

Cross-border investing boosts contagion risk, study finds

More countries now capable of triggering a wider crisis