Infrastructure

On the level

convertibles

Two of a kind?

Equity default swaps

The iconoclast of Brooklyn

Profile

Daiwa Securities SMBC launches first rated CDO of EDS

Japan’s Daiwa Securities SMBC has launched a CDO of equity default swaps (EDS), making it the first pure EDS portfolio to be rated globally.

Understand qualitative aspects of operational risk first, says DTCC

The qualitative aspects of operational risk must be understood before focusing on the quantitative measurements of operational risk capital, according to Eileen Robbins, vice-president for operational risk management at the Depository Trust and Clearing…

Major op risk software providers grow at expense of smaller rivals

Sales of operational risk solutions seem to be on the rise, but it is established vendors who are seeing deals close. Many small or new software houses in the op risk space seem still to be experiencing a lull in sales.

All change on the BIS op risk team

Three well-known regulatory figures will be changing places over the course of February as various secondment arrangements between the Bank for International Settlements (BIS), the Bank of England (BofE) and the Federal Reserve in the US come to an end.

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch's energy trading business. He has now pleaded guilty to a $43 million fraud.

The science of compliance

The Sarbanes-Oxley Act is placing urgent demands on many US companies for accurate reporting of financial information. Clive Davidson reports on the implications for financial technology.

A complex framework

Many Japanese financial institutions now conduct their derivatives business through their securities firms, but there are a number of legal risks in using a securities dealer as a derivatives trading entity, writes Tan Ser Kiat of Denton Wilde Sapte…

Preemptive strike

The prospect of Eliot Spitzer launching a probe into fixed-income research has prompted the BMA to draw up a set of guiding principles for the industry. But some investors are questioning the motivation for such an initiative.

Parmalat focus: Tragedy or farce?

Corporate Europe has been gripped by a scandal that has led to the downfall of one of Italy's largest and most established companies – dairy producer Parmalat. Bondholders don't know whether to laugh or cry at the size of the fraud.

Order Management Systems Clamp Down

Banks are looking to Order Management Systems to achieve compliance, settle trades and take advantage of liquidity. Are your traders ready for the coming Bull Market?

Basel across boundaries

With branches spanning Asia, the Middle East, Africa and Latin America, Standard Chartered faces a number of challenges in implementing the new Basel Accord. Yet Richard Meddings, the bank's group risk director, has his eye firmly fixed on the most…

US Congressman blasts Basel II while supervisors forge ahead

A US Congressman sent waves of panic across Europe when he announced at a fringe event of the World Economic Forum in Davos, Switzerland in late January that he had serious reservations about whether the US would ever adopt Basel II.

Bracing for Basel

When international banking supervisors met in Basel, Switzerland in 1999 to propose a new framework for capital adequacy, they set in motion the biggest shake-up of the decade as to how banks measure risk and allocate capital. The new proposals, called…

Prebon re-enters credit derivatives market

Prebon Marshall Yamane has opened a credit derivatives desk in London, having sold its original team to CreditTrade, the online credit derivatives trading portal, in February 2000.

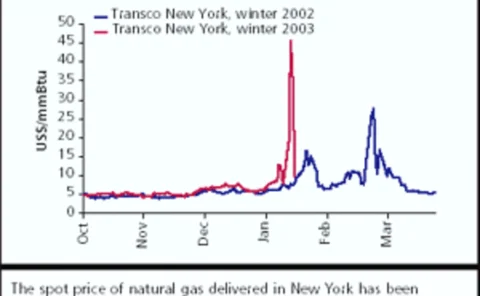

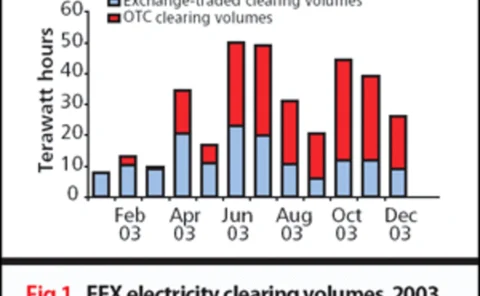

Storms ahead

Rankings 2004

Trading techniques

Rankings 2004

EU transparency: Lost in translation

Many credit market participants agree that a single European financial services market would be good for all concerned. But there is widespread doubt over whether the EU is the right architect for the project.

Upwardly mobile

Rankings 2004

Taking the slow road

Rankings 2004