Infrastructure

Observations on the differences between operational risk regulatory and economic capital

In this article, Niklas Hageback takes a practical look at the difficulties in reconciling regulatory and economic capital calculation in the discipline of operational risk.

Energia selects SunGard’s Entegrate ZaiNet

Energia, part of the Viridian Group, has selected SunGard’s Entegrate ZaiNet for the straight-through processing and risk management of its physical and financial power and gas contracts.

Sponsor's Article > What are loan loss reserves?

Few things are more frustrating to businesses than to be subjected to contradictory requirements by multiple authorities. Modest inconsistencies are glossed over with little or no harm. David Rowe argues, however, that conflicting definitions of loan…

Taking on the big boys

Sean Egan, co-founder of Egan-Jones Ratings, talks to Dalia Fahmy about his frustration at the restrictive structure of the credit rating industry and his plans to turn Egan-Jones into a serious contender to rival established players, Moody's, S&P and…

Delivery failure

Perturbed by last year's spike in settlement failures on the May 2013 Treasury note, investors have been assessing the likelihood of a repeat scenario. So what causes these fails situations, and how can they be avoided?

Isda called on to improve OTC commodities market

Elaine Whiting, head of global over-the-counter commodities transaction documentation and management at Barclays Capital, yesterday called for assistance from financial institutions to create operations 'metrics' for OTC commodities markets.

Creditex adds Mark-it’s ‘Red’

Credit derivatives broker Creditex is to incorporate pricing data provider Mark-it Partner’s reference entity database (Red) into its trading and information platform.

TCV market risk system upgrade prepares for credit risk and Basel II

Treasury Corporation of Victoria (TCV), the central financing authority of the State of Victoria in Australia, has implemented a system to improve its market risk management, which it plans to extend to cover credit risk and that should help it meet…

SIA announces business continuity guidelines for "Unexpected Market Close"

The Securities Industry Association's Data Management Division has announced guidelines to direct the industry in order routing, clearing and settling equities and options during an unexpected market close.

Regulators put credit risk transfer in the spotlight

Leading financial services regulators have placed the credit risk transfer market under scrutiny to establish if instruments such as credit derivatives and synthetic collateralised debt obligations (CDOs) pose a threat to financial stability.

Risk Into Value

Investment firms have plenty to consider in the race to achieve Basel II and operational risk mandates.

Dollar distress

Scottish Power has announced a £400 million cash windfall through its currencyhedging programme. Others have not been so lucky – but everyone is nowwaking up to currency trading. By James Ockenden

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

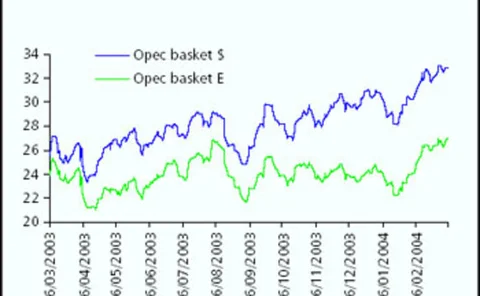

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

Rethinking Kyoto

A long-awaited debate on the Kyoto Treaty has begun in Europe. Just how muchwill it cost industry and the EU economy? Long-term Energy Risk contributor MariaKielmas gives her views on the latest developments

ESB wins Esso price battle

A high court judge has rejected claims by Esso it should be allowed to raise the price of gas supplied to Ireland’s Electricity Supply Board (ESB) on the basis of prices reported in the Heren Report .

Reuters names treasury head

Reuters has named Mark Robson its global head of treasury and fixed income, during a year when the UK company has placed the development of its treasury business as a high priority.

Dynamically self-propelled capital gains

The Ballistic Long/Short Emerging Equities Fund has achieved impressive returns in recent years. Its manager, David Murrin, shares some of the secrets of his success

Standing out from the crowd

Hugh Hendry has achieved great success at Odey Asset Management by applying his own personality to the firm's Eclectica Fund - and by not following the crowd

PD estimates for Basel II

One of the main issues banks will have to face to comply with the new Basel II internal ratings-based approach is to prove that the long-run average probabilities of default they assign to their clients, which will be used as the basis for regulatory…

Pricing potholes

Valuation

Mixed signals

Global credit

The correlation conundrum

Credit Defaults