Infrastructure

Architecture and compensation

The risk architect

Foreign exchange volumes up by a third

Foreign exchange trading volumes are up by nearly a third over the past three years, according to new research from UK consultancy ClientKnowledge.

First Irish covered mortgage bonds set to debut

Bank of Ireland's mortgage banking unit is readying the country’s first issuance of covered bonds backed by a pool of residential mortgages. The €2 billion issue, which will be triple-A rated, is set to be priced within the next month. Barclays Capital,…

EU CAD: behind the smiles

The industry is putting on a brave face when commenting on the latest proposals for the EU Capital Adequacy Directive, but all is not as it seems.

Bank of Italy official posts op risk paper

In mid-July, an official from the Bank of Italy posted a paper, The modelling of operational risk: experience with the analysis of the data collected by the Basel Committee, which is beginning to garner attention in international op risk circles.

EU CAD: behind the smiles

The industry is putting on a brave face when commenting on the latest proposals for the EU Capital Adequacy Directive, but all is not as it seems.

Bank of Italy official posts op risk paper

In mid-July, an official from the Bank of Italy posted a paper, The modelling of operational risk: experience with the analysis of the data collected by the Basel Committee, which is beginning to garner attention in international op risk circles.

EU CAD: behind the smiles

The industry is putting on a brave face when commenting on the latest proposals for the EU Capital Adequacy Directive, but all is not as it seems.

Basel II and the single-instrument bank

Banks could take a cue from the construction industry if they want to lessen the burden of Basel II, argues Ron Dembo.

Dollar/yen break-out expected

Technical indicators suggest the dollar/yen exchange rate could be set to break out of the tight trading range it has been trapped in since June, says RiskNews’ sister publication, FX Week .

Isda pushing bar codes for confirmations

The International Swaps and Derivatives Association is working on a new bar code standard to streamline the processing of trade confirmations across a variety of asset classes, according to RiskNews’ sister publication, Dealing With Technology .

Reassessing self-assessment

Traditional approaches to assessing and controlling operational risk within institutions are outdated, argues Gerald Sampson. Self-assessment needs rethinking, and proper risk evaluation is far better served if risk management departments assume their…

LCH Clearnet launches OTC clearing for UK gas and power

London-based clearing house LCH Clearnet today launched its new clearing service for over-the-counter (OTC) contracts for UK national balancing point natural gas and UK peak and baseload power contracts.

Cantor Fitzgerald to spin off its global voice brokerage business

Cantor Fitzgerald will spin off its global voice brokerage business as a new company, BGC Partners, effective from October 1 this year.

Complex products rule deemed 'too broad'

Three financial services trade associations released a critical joint response to the US banking agencies' proposed rule on complex structured transactions in mid-July.

User Choice winners revealed

Energy Risk's first User Choice Awards have been a tremendous success, with over 450 valid votes showing which vendors and data providers are the preferred suppliers to the energy industry in 2004.

EnergyCurves to market North American energy data

Four energy brokers have formed a Houston-based company called EnergyCurves to provide North American power and gas data services to the energy markets. The initial EnergyCurves products will be forward price curves for the North American gas and power…

New rules for a new era

The UK's new rules designed to implement a risk-based regime for regulating the insurance industry are due to come into place at the end of the year. John Ferry talks to the Financial Services Authority about what this means in practice for insurance…

Europe's insurers get used to a stricter regime

Regulators are increasingly bearing down on insurers as the market looks to establish better risk management practices. With the Solvency II proposals being drafted, what are insurance companies doing to make sure they can comply with the stricter…

Op risk expenditure to shoot up, predicts report

Expenditure on operational risk technology systems will rise to $8.2 billion by 2007 from the current level of $5.2 billion, according to research published by Towergroup, the Massachusetts-based technology consultants.

Citigroup to acquire Knight’s derivatives markets business

Citigroup is set to acquire the derivatives markets business of New Jersey-based trade execution services firm Knight Trading in the fourth quarter.

Basel harmony still a long way off, notes IIF

“No-one really appreciated the complexity of the whole [Basel Accord] process,” says Charles Dallara, managing director at the Institute of International Finance (IIF). “It is only in the last nine months that regulators and bankers have woken up to the…

All systems go

Weather risk

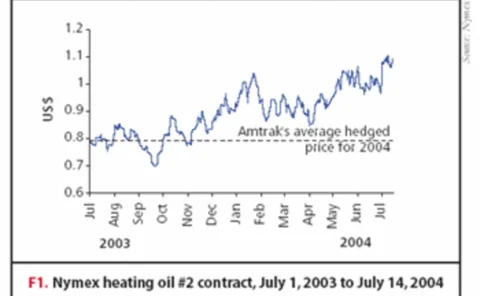

Dealings in diesel

Weather risk