Infrastructure

What hedge funds need to know about energy derivatives

energy derivatives

Hedge funds as portfolio diversifiers

special report: structured products

Hedge funds lured by the choppy waters of freight derivatives

freight derivatives

Taking a hands-on approach

shareholder activism

Chris Bowden

With energy prices skyrocketing, risk management is now a necessity, not an option, says energy risk pioneer Chris Bowden . By Stella Farrington

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports

Growing up fast

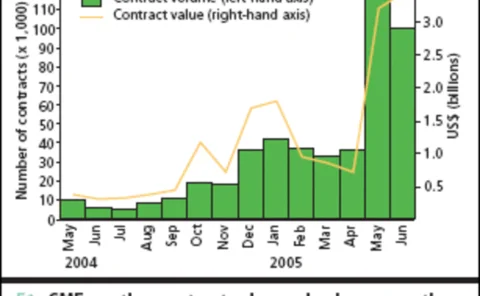

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Making an impact

It can affect as much as 20% of the US economy, and nearly every industry worldwide is affected by it. But blaming poor results on the weather is no longer an excuse: weather derivatives are on the rise. Eric Fishhaut reports from Chicago on the growth…

Blowing hot and cold

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

Briefs

REGULATORY UPDATE

Losses & Lawsuits

LOSS DATABASE

Economic capital blues

Focus: Rating agencies

Whose risk is it anyway?

Pensions Reform: In the Spotlight

Resolution

Practitioner Profile

The long road to LDI

Pension Funds: Liability-Driven Investment

Fonds de Reserve pour les Retraites

Practitioner Profile

Raiffeisenbanken und Volksbanken Lebensversicherung (R+V)

Practitioner Profile

The Secret CDO

Cover Story

The multi-period explosion

Technology: Asset-Liability Management

Guaranteed to take the credit

Credit CPPI

Basel II costs rising, says survey

New angles

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports