Credit - 2007-01-01

Articles in this issue

A state of equilibrium

Flows in the tranche market have balanced out - at least for now. Our US columnist StreetCred wonders whether valuation discrepancies may soon upset the applecart

Liquidity survey

Secondary market liquidity

CPDOs: A volatility game

A triple-A rated structure that pays Libor plus 200bp. Who wouldn't be interested in such a product? Perhaps the sceptics warning against the 15 times leverage and the instrument's high exposure to volatility. Laurence Neville reports

Robert Lepone

The head of European loan trading at Morgan Stanley in London discusses issues surrounding the new loan CDS indices

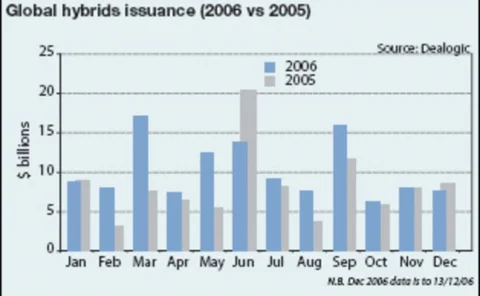

Ratings shake-up threatens to take the fizz out of buoyant hybrids market

Indications by Moody's that it may downgrade certain types of hybrid securities have perturbed investors still sensitive after the NAIC's recent flirtation with classifying hybrids as equity

Italian telco Wind whips up a storm in credit markets with mammoth PIK note

The EUR1.7 billion record-breaking payment-in-kind deal priced well inside guidance levels, but there is concern that investors are underestimating the credit risk of such deals

Geoffrey Gwin

The clues to bond selection are in a firm's income statement, says the chairman of hedge fund Group G Capital Partners. He talks to Dalia Fahmy about his $115m long/short high-yield fund

Back to basics

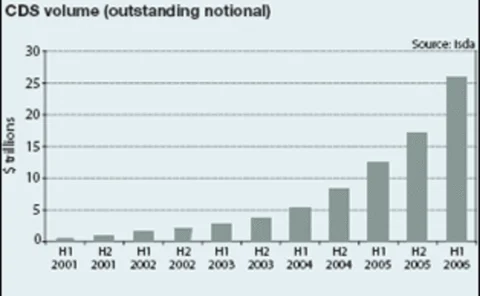

We take you back to the credit basics to review everything you thought you already knew but were too afraid to ask... In the second of a two-part series on credit derivatives, Saul Doctor, analyst at JPMorgan in London, discusses next-level CDS

CDS volumes to top $30 trillion this year

According to Deutsche Bank estimates, the credit default swap market will continue to grow this year - albeit at a slower rate - as a wider pool of investors gain approval to enter the market

Talkingpoint - 2007 outlook

Change is in the air for 2007. A deterioration in credit quality and concomitant rise in default rates may presage a tough year. We asked five leading market participants for their outlook

False dawn for first loss

CDO equity

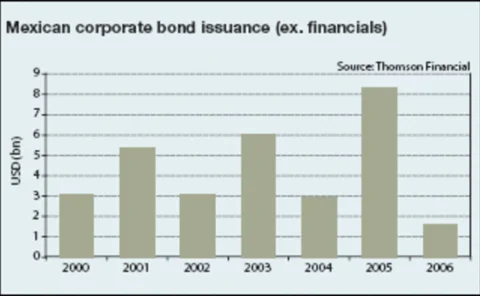

GMO's emerging market high-flyers

Bill Nemerever and Tom Cooper, co-managers of GMO's emerging markets debt portfolio, have made their names sourcing cheap debt in unusual locations. Shunning roadshows and local currencies, they barely even travel to the countries they invest in. Dalia…

Investment grade

Secondary market liquidity

Plotting the spread cycle

Marketgraphic

Creditex offshoot launches credit derivatives portfolio trading system

Q-Wixx aims to cut the time it takes to trade large portfolios of credit derivatives; Cairn Capital and four dealers test drive system due for launch in January