Risk Quantum/Fifth Third Bank

Fed review of mortgage servicing risk-weight to help Western Alliance most

Bowman proposal to revisit 250% risk-weight could reshape $92 billion of RWAs

US regionals predict prolonged AOCI burndown

Six banks adjust capital projections amid rising unrealised losses in Q4

AFS Treasury holdings surge $67bn at US banks in Q3

JP Morgan leads growth, while Citi and Wells Fargo cut back

Record number of US banks turned to riskless assets in Q1

Western Alliance leads pack with doubling of exposures in 0% bucket

US banks’ IRRBB transparency: one step forward, two steps back

A year on from the 2023 crisis, more lenders monitor EVE sensitivity, but full Basel-like disclosures remain the exception

At some US regionals, CRE loans eclipse tangible equity by up to 7x

Valley National, NYCB and First Foundation the most levered in a sample of 30 banks

Latest FDIC special assessment tougher than 2009 version

Most US banks face higher toll under new methodology

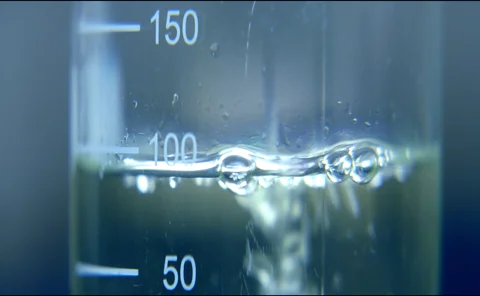

US banks rejig securities to cut mark-to-market losses

Fifth Third leads charge with $12.6bn transfer from AFS to HTM pen

Adjusted for AOCI, ratios at five regional banks fall short

Impact of reinclusion on CET1 capital ratio would trip up Truist, Ally and others