Sponsored content

Follow Sponsored

Articles by Sponsored content

Building reliable and successful LLM-based workflows

How AI is reshaping analytics, compliance and modelling in finance

Energy supply chains seen as a growing risk

Supply chain risk is now a major concern, with some firms even viewing it as an existential threat

Financial crime product of the year: LexisNexis Risk Solutions

LexisNexis Risk Solutions wins Financial crime product of the year at the Risk Technology Awards 2025

From fragmented signals to confident credit decisions

Credit Benchmark and Oliver Wyman explore how aggregated bank data and advanced analytics are helping risk teams make confident, forward-looking credit decisions

Energy Risk Software Rankings 2025: ION Commodities interview

The outlook for energy and environmental markets, and ION’s strategy around AI

A paradigm shift for prepayment risk assessment

For MBS investors, the ability to link data to specific loans and securities offers more precise analysis, alongside other advances in data and analytics

AI in capital markets: bridging predictive precision with generative possibility

Regulatory requirements, compliance demands and concerns over data quality and consistency are prompting firms to approach AI with renewed caution and clarity

Bank ALM system of the year: Prometeia

Reflecting the strength of Prometeia’s ALM platform and the firm’s alignment with the needs of modern risk and performance management

Energy Risk Awards 2025: Nodal Exchange interview

Energy and environmental markets outlook, the impact of AI on power markets and Nodal Exchange’s plans

Global macro shifts: can emerging markets navigate a fragmented world?

Franklin Templeton expects certain emerging markets to benefit during the realignment of global political and trading blocs

TP ICAP: leveraging a unique vantage point

Market intelligence is key as energy traders focus on short-term trading amid uncertainty

Best in-house risk data initiative: EFG Bank

EFG Bank’s Digital Risk Pilot unifies risk data, enhances analytics and reporting, and empowers decision-makers with enterprise-wide insights

IFRS 9 solution of the year: Acies

Acies’ Kepler IFRS 9 solution recognised for speed, scalability, ability to streamline compliance and enhance credit risk analysis

Best in-house credit risk technology: Generali Asset Management

Generali’s platform uses predictive analytics and systemic mapping to manage credit risk across €230 billion in assets

Credit data provider of the year: Credit Benchmark

Credit Benchmark delivers comprehensive insights and extensive coverage so financial institutions can make informed decisions

Enhancing operational resilience during geopolitical uncertainty

How financial institutions can strengthen operational resilience and navigate disruptions

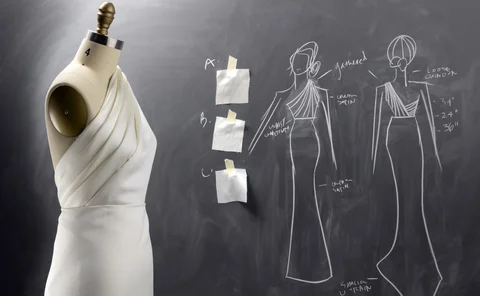

Precision-crafted: the new tools of investing

Key trends, tactics and innovations that are influencing investors’ thinking in the current environment

Fixed income finesse: striking a balance amid shifting rates

An increasingly unpredictable economic environment leads investors to look for a wider range of products to satisfy evolving strategies

Volatility and geopolitical risk fuel new approaches to energy trading and risk management

Energy market participants seek new tools and signals to navigate near-term volatility and long-term uncertainty