Sponsored content

Follow Sponsored

Articles by Sponsored content

Technology risk management: detection to protection

From simple risk detection to comprehensive protection by expanding your vision, capabilities and influence

Mitigating model risk in AI

Advancing a model risk management framework for AI/machine learning models at financial institutions

2025 capital market expectations: slowing but not sinking

Monetary policy is the governor of the relationship between growth and inflation

Yen rise spurs Japanese rates market surge

Traders are moving on an expectation of increased yen volatility in 2025

Strengthening technology resilience and risk controls against multidomain disruption

The consequences of multidomain disruption and best practice strategies to enhance digital resilience

The key traits of resilient E/CTRM systems

An Energy Risk Europe panel explored whether E/CTRM systems are meeting the evolving demands of traders

Revolutionising compliance: next-gen technology for new-age regulation

A whitepaper exploring prevailing compliance challenges and the implications of regulatory changes on data and reporting technology

Strategies for navigating market volatility in the post-US election landscape

Market volatility following the US election, including inflation risks, commodities, geopolitical uncertainty, ESG considerations and the role of advanced analytics in investment strategies

Charting volatility: strategic insights on Apac monetary policy divergence and market dynamics

Key drivers of market fluctuations, the impact of currency and interest rate differentials, and technology-driven strategies for risk mitigation in portfolio management

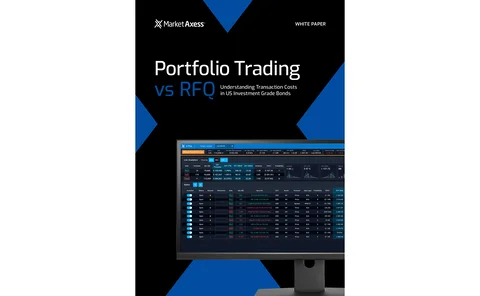

Portfolio trading vs RFQ: understanding transaction costs in US investment-grade bonds

How factors such as order size, liquidity profiles and associated costs determine whether a portfolio trade or RFQ list trade is the optimal choice

From faxes to fintech: reflecting on more than 20 years of industry evolution

Financial markets have evolved from manual processes to streamlined, technology-driven workflows. This article covers this transformation and the collaborative innovations reshaping post-trade operations

Revolutionising credit surveillance: part two

Does GenAI live up to the hype? How prioritising AI and digitisation projects reveals data as the power behind AI initiatives

Elevating risk management to a strategic partner in investment decision-making

How risk management is evolving from a compliance role to a strategic partner