Risk Staff

Follow Risk

Book contributions by Risk Staff

Portfolio Construction and Management

Edited by Brice Benaben and Julien Jarmoszko

Articles by Risk Staff

Portugal’s first synthetic securitsation on tap

Banco Comercial Portugues (BCP) and Kreditanstalt für Wiederaufbau (KfW) are bringing to market the first synthetic securitisation transaction in Portugal. A portfolio consisting of Portuguese small and medium-size enterprise (SME) loans will be brought…

Babson Capital hires Kung for alternatives

Babson Capital, the Massachusetts-based asset management firm, has hired Edward Kung as alternative product manager.

E-Capital launches ethical CDS index

E-Capital Partners, the Milan-based financial advisory company that specialises in socially responsible investment (SRI), has launched an index for ethical credit default swaps (CDS).

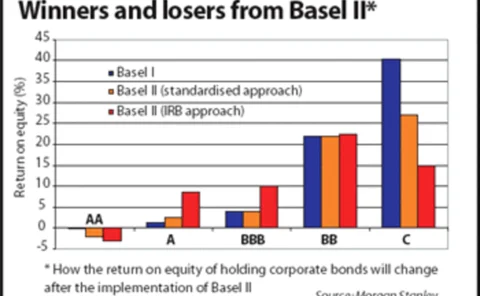

Basel II to boost bank bondholdings

Basel II could have a major impact on the bond markets, according to a new report from Morgan Stanley.

The Carrots and Sticks of Compliance

Compliance on the buy side might reward the early adopters while penalizing firms that fall afoul of industry best practices and institutional investors' expectations.

Goldman Sachs Looks Ahead

As global head of technology and operations for Goldman Sachs, Randy Cowen reveals his thoughts on next year's IT budget, hiring versus outsourcing, today's uncertain future, and what keeps him awake at night.

Insolvency: a survival guide

The collapse of Parmalat has forced European legislators to take a long, hard look at the laws governing insolvency. Moves are now afoot to bring these regimes more in line with a Chapter 11 style of bankruptcy legislation, as Oliver Holtaway discovers

BNP Paribas brings securitisation origination into financial institutions group

BNP Paribas has incorporated securitisation origination into its financial institutions debt capital markets (FIG DCM) team in order to strengthen and broaden coverage.

Isda taps new chairs

The International Swaps and Derivatives Association has elected a new chairman and vice-chairman. Jonathan Moulds, head of cross-product strategic trading at Banc of America Securities, has been elected chairman, while Michele Faissola, global head of…

SEC finalises rules on hedge fund registration

The much anticipated SEC decision regarding US-domiciled hedge fund registration raised few eyebrows when it was announced late last month. It was clear, therefore, that hedge fund registration was only a matter of time, but what is less clear is the…

Volkswagen announces first true sale securitisation

Volkswagen Bank announced this week its intention to securitise some €1.1 billion in auto loans using the German True Sale International (TSI) platform.

Lehman to offer onshore forex derivatives in South Korea

Lehman Brothers has transferred JS Kim, a senior vice-president in fixed income, from Tokyo to Seoul, in preparation for the launch of its onshore forex and interest rate derivatives business in the country, reports Risk’s sister publication, FX Week .

BoA loses French corp sales dealer

Olivier Brouet has left Bank of America (BoA) in London, where he worked in FX sales to French corporates, reports FX Week , Risk ’s sister publication.

RBS to offer interest rate swap trading through Bloomberg

Royal Bank of Scotland’s (RBS) London-based Financial Markets division has expanded its Bloomberg Electronic Trading offering by adding euro interest rate swaps.

Non-US airlines profit from low-flying dollar

The weak dollar is giving airlines outside the US some relief from the impact of high fuel costs, according to their latest financial results, reports Risk’s sister publication, FXWeek .

BNY sales head joins EFG Bank Group

Raymond O'Leary, formerly head of European forex sales at Bank of New York (BNY) in London, has joined EFG Bank Group, a private bank based in Geneva.

A solution to counterparty credit risk?

The race is on to find a solution to outstanding issues such as counterparty risk, double default and the treatment of illiquid assets on trading books before Basel II is enshrined in regulation.

Fannie under fire from Ofheo

Last month, US mortgage agency Fannie Mae came under fire from its regulator – the Office of Federal Housing Enterprise Oversight (Ofheo) – for accounting and operational failures, about a year after sibling mortgage agency Freddie Mac became embroiled…

US financial institutions face major challenges under Basel II, says Financial Insights

Financial institutions in the US face tremendous challenges under the new Basel Accord, also known as Basel II, according to Financial Insights, a financial services research firm based in Framingham, Massachusetts.

HSBC revises research offerings

Global banking group HSBC has reshuffled the research offered by its research arm.

Fannie Mae earnings filing delayed

US mortgage agency Fannie Mae will not file its third-quarter earnings report on time, and may be hit with approximately a $9.0 billion loss if an investigation into its accounting practices reveals it did not qualify for hedge accounting, the…

Algorithmics rolls out Basel II tool

Algorithmics, an enterprise risk management solutions specialist, and FRS, a global provider of regulatory and financial reporting solutions, have entered into an agreement to deliver regulatory reporting within the Algo Capital solution.

ABN Amro buys Portuguese securitisation company

Dutch bank ABN Amro has bought the Portuguese securitisation company Servimedia SGFTC from Banco Comercial Portugues (BCP), to consolidate servicing capabilities for securitisation clients in the region.