Kris Devasabai

Editor-in-chief, Risk.net

Kris Devasabai is the New York-based editor-in chief of Risk.net. Previously, he was bureau chief and US editor of Risk magazine. He manages the editorial team. Prior to joining Risk, Kris covered hedge funds, asset management, cross-border investing and law for several publications.

Kris holds a bachelor’s degree in law and government from the University of Manchester, and he completed his legal training at the Inns of Court School of Law in London. He was called to the bar of England and Wales in 2003.

Follow Kris

Articles by Kris Devasabai

Libor battles aren’t over, but the war is won

Transition will shift into new phase next year, leaving systemic threats behind

How State Street came to vote against polluting companies

SSGA will vote against companies that do too little on climate, but won’t abandon them entirely

Copping out on climate change: buy-side risk survey

Only 9% say front-line staff have climate role today – specialists call for better metrics and link to pay

The unintended consequences of ring-fencing

Rules aimed at protecting UK depositors may be putting too much froth into the credit market

How XVA quants learned to trust the machine

Initial scepticism about using neural networks for derivatives pricing is giving way to enthusiasm

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Rough volatility’s steampunk vision of future finance

Some of the trickiest puzzles in finance could be solved by blending old and new technologies

NSFR may clear up questions about Nomura’s balance sheet

The risks of off-balance sheet financing remain largely hidden from view

Why US dollar Libor spreads may be mispriced

Fallback spreads for all currencies could be fixed together, even if some benchmarks survive past 2021

Basis trades: a test case for regulating risky activities

FSOC is right to focus on dangerous behaviour, but Treasury meltdown reveals a complex chain of actors

Corporate bond markets need more transparency – not less

Regulators should do more to promote pre- and post-trade transparency in corporate bonds

Mariner’s CRO on avoiding predictable surprises

Buy-side risk survey: relative value specialist builds shocks into investment strategy

Sonia term rate nears ‘beta’ release, while SOFR struggles

ARRC chair says current liquidity in SOFR derivatives is insufficient to create a term rate

Libor death notice could be served this year – FCA

Announcement may come soon after Isda’s fallback protocol takes effect in November

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

Secrets and Libor fallbacks

Lenders may be forced to reveal sensitive funding data when Libor disappears

Bank disruptors: JP Morgan smashes silos

To foster innovation, the US banking giant rebuilds its culture by breaking boundaries

Bank disruptors: BofA’s ‘citizen devs’ take on innovation mantle

Central data and technology group enables frontline ‘citizen developers’

Bank disruptors: tread carefully and bend things

How BofA, SocGen, JP Morgan, Nomura, UBS and others are disrupting themselves

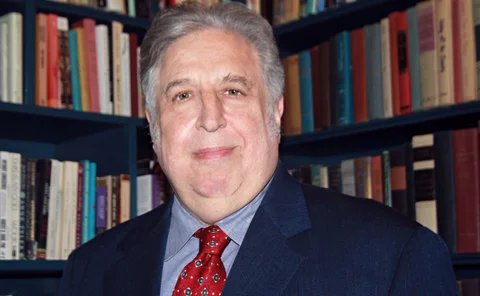

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

The backlash against green weightings

Banks get a lot of flak for not doing enough to mitigate climate risks

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

Plumbing problems in the repo market

On September 17, three banks may have sucked up nearly a quarter of money market fund cash

In stress-test window-dressing, timing is everything

EBA and Fed stress tests would have to be in perfect sync to stamp out transatlantic arbitrage