SOFR

New Isda definitions pave way for bespoke swaps clearing

Pick-and-mix grid of floating rate options will make it easier to clear post-Libor bond hedges

Libor is ending, and corporates need to know their options

Banks must speak to Main Street now if US Libor transition is to succeed, argue ARRC working group leaders

A BMR-shaped hole in the US Libor transition

US could benefit from copying EU Benchmarks Regulation as market moves to shaky Libor successors

Fractured Libor transition halts US structured rates switch

Issuance of non-Libor caps and floors dries up as lending markets mull array of credit-sensitive SOFR rivals

Confusion reigns as US prepares for Libor’s end

Mixed messages from US regulators make it more difficult to plan for life after Libor

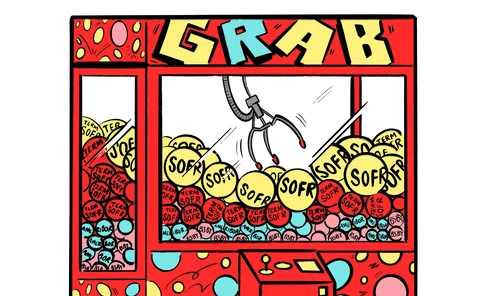

Pick a rate: pitfalls and prizes in the post-Libor world

SOFR set to win big in replacing Libor, but trillions could scatter across alternatives

Time to end debate on SOFR alternatives, participants warn

Doubt over future of five credit-sensitive Libor replacements may be hindering late-stage Libor transition

SOFR alternatives remain on track despite regulatory warnings

Pointed criticism from FSOC has done little to dampen interest in credit-sensitive rates

SEC’s Gensler takes aim at Bloomberg’s BSBY index

Credit sensitive SOFR alternative has “many of the same flaws as Libor”, regulator says

The Libor replacement stakes: runners and riders

Credit-sensitive rates Ameribor and BSBY nose ahead of Ice, Markit and AXI; regulators keep watchful eye

Rush to meet net-zero target could see Sonia, SOFR collapse

Policy inaction could halt benchmarks’ normalisation, BoE biennial exploratory scenario finds

Dealers back ‘SOFR first’ in bid to jump-start new rate adoption

Term SOFR recommendation would follow “in days, not weeks” of US swaps quoting convention switch

Libor Risk – Quarterly report Q2 2021

The countdown to Libor's demise is officially under way. If a recent jump in Libor usage is anything to go by, regulators face a Herculean task prising dollar markets off the discredited rate by year-end. The mission is complicated by huge swathes of the…

ARRC eyes July ‘SOFR first’ switch

Adoption of RFR for swaps quoting conventions should pave the way for term SOFR endorsement

Markit launches credit-sensitive SOFR alternatives

Crits can be used as add-on to SOFR, while Critr will be a standalone benchmark

Clock auctions: a stitch in time for Libor?

MIT professor says Nobel-inspired mechanism could cut basis risk and ease $74trn Libor shift

CME wins term SOFR race

Fed-backed working group puts term rate back on track, but low volumes keep endorsement on hold

Prudential, Goldman cast doubt on Libor-like replacement rates

Isda AGM: Participants split on case for credit-sensitive rates in post-Libor world

Accurate RFR hedges face liquidity trade-off, participants say

Isda AGM: Aligning swaps with assorted cash market conventions requires users to weigh liquidity cost

Corporates remain on swaps fallback sidelines

Risk.net analysis finds just 14 out of 100 large non-financial firms have signed up to Isda fallback protocol

ARRC’s Wipf ‘puzzled’ by appeal of Libor-like benchmarks

Credit-sensitive benchmarks face questions over inputs and compliance

CME unveils term SOFR in face of ARRC doubts

Exchange group says benchmark aligns with ARRC principles – but committee has pushed back endorsement plans

Botched fallbacks leave CLOs facing early Libor switch

Nearly two-thirds of CRE securitisations issued since 2019 have already triggered fallback clauses

FCA could get legal with USD Libor laggards

Incoming powers permit regulator to ban use of benchmarks with known cessation dates – but only for UK-supervised firms