Skew

Currency derivatives house of the year: UBS

Risk Awards 2022: T-Pricer platform enabled bank to gain technological edge

Follow the moneyness

Barclays quants extend Bergomi’s skew stickiness ratio to all strikes

Sticky varswaps

Bergomi's skew-stickiness ratio is extended to the setting of variance swaps

The step stochastic volatility model

Extreme short-dated skew can be obtained by decomposing it in two parts

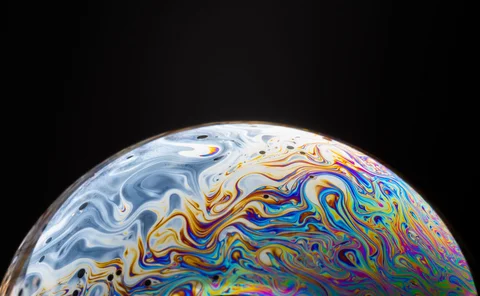

Jarrow and co find a better way to spot stock market bubbles

Quant team’s options-based approach avoids pitfalls of historical data dependence

Structured products house of the year: Credit Suisse

Risk Awards 2021: Private bank tie-up provided vital risk-sharing outlet for Covid volatility

Credit derivatives house of the year: Credit Suisse

Risk Awards 2021: Hedging before the crisis allowed bank to offer ample liquidity when markets tanked

Smaller drawdowns, higher average and risk-adjusted returns for equity portfolios, using options and power-log optimization based on a behavioral model of investor preferences

The authors use a power-log utility optimization algorithm based on a behavioral model of investor preferences, along with either a call or a put option overlay, to reverse the negative skewness of monthly Standard & Poor’s 500 (S&P 500) index returns…

Quants tout alternative carry trades for the ‘new normal’

Low rates and flatlining yield curves leave investors seeking carry in swaps and swaptions

The joint S&P 500/Vix smile calibration puzzle solved

SPX and Vix derivatives are modelled jointly in an arbitrage-free setting

Dark materials: how one academic is delving into data

David Hand shines a light on dark data and the dangers of distortion by absence

Sterling option volatility spikes on Brexit deal news

Trading reaches crescendo on Friday; insiders warn of further volatility

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

The credit skew market’s surprise package

Mediobanca’s €1.6 billion in issuance makes small Italian investment bank a market titan

Brexit drama muddies water for FX options market

Traders focusing on new dates – and scenarios – after domestic UK criticism of proposed deal

Statistical analysis of photovoltaic and wind power generation

The author presents a comparison between maximal and daily average production of photovoltaic and wind energy based on a transmission system operator in Germany using statistical analysis with different seasonality functions.

Auditors: the extra line of defence

If CDS skew spikes, some banks may be thankful for conservative accountants

Commodity volatility, skew and inverse leverage effect

Krzysztof Wolyniec on leverage effects and volatility in commodity markets

Volatility traders wrestle with digital risk of Brexit

Skew on major indexes leaps after market wakes up to risks of UK's referendum

Totally skewed: US annuity hedges magnify S&P volatility

Dealer hedging of popular retirement products affecting index greeks, say traders

Sliding HSCEI threatens fresh autocallable losses

Banks nervy as index approaches key options barrier

Correlation skew via stochastic correlation and jumps

Valer Zetocha introduces a correlation model based on the Jacobi process with jumps

Korean crunch: how HSCEI fall hammered exotics desks

Dealers lose over $300 million in scramble to hedge autocallables