Single supervisory mechanism (SSM)

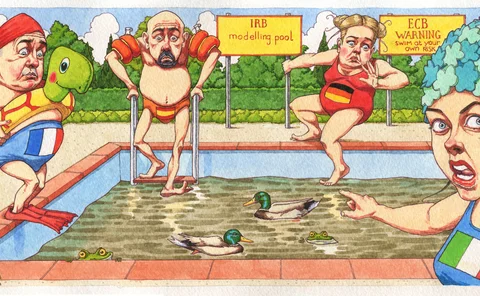

Banks turn away from FRTB internal models in Europe

Drawbacks mean even fewer model approval applications planned than past ECB survey suggested

SRB faces tough choices over Sberbank Europe failure

Both resolution or liquidation could lead to losses for public purse, depending on client base

EU looks to close Brexit escape route from ECB supervision

Changes to capital regulation would stop national rulebook arbitrage deployed post-Brexit

Basel turns attention to non-climate-related environment risks

Experts warn of over-complicated framework if nature-related risks are added prematurely

EC expected to apply output floor at group level only

‘Parallel stacks’ proposal unlikely to appear in first draft of CRR III, due next month

ECB tightens grip on back-to-back booking models

Supervisor could impose large exposures limit for intragroup trades, even if UK granted equivalence

Demand escalates for reform of EU bank resolution rules

SRB chair, Spanish MEP and Danish resolution chief join push to end regional bank bailouts

ECB grants post-Brexit reprieve on large exposures limit

Exemption for intra-group exposures to UK will be preserved pending a decision on equivalence

FSB offers loud warning and muted response on climate risk

Global regulators say risks are near-term and cross-border, but propose only data collection

European banks want clarity on post-Covid capital rebuild

Supervisors urged to explain what will happen when pandemic relief on capital buffers expires

EU urged to pass permanent market risk capital relief

Council agrees temporary changes, but ECB’s Enria wants legislators to trust supervisors

Rewards for failure: the ECB’s topsy-turvy market risk relief

Eurozone banks with better models are least able to offset Covid-driven rise in backtesting multiplier

Leaked EU document casts doubt on leverage ratio relief

Several MEPs oppose leverage exemption for sovereign bonds, but some want SA-CCR fast-tracked

BoE and ECB weigh calls to follow US lead on capital relief

European regulators face pressure to exempt sovereign exposures from leverage ratio

Eurozone banks fear market risk capital hike due to Covid-19

Hopes that ECB will fix double-counting as VAR breaches rise on market volatility

Regulatory lenience over Covid-19 must be carefully judged

Former ECB supervisory board member says unwinding regulatory relief later will take courage

Splits emerge over EBA’s stress test 2.0

Experts question utility of separate bank leg that won’t feed into capital requirements

ICAAP/ILAAP – Unlocking business value from capital and liquidity assessment

Regulators consider banks’ internal capital adequacy and assessment process (ICAAP) and internal liquidity adequacy assessment process (ILAAP) important tools in managing risk. The European Central Bank’s (ECB’s) updated guidance – which came into effect…

Enria: no reason for EU to deviate from Basel output floor

ECB supervision chief urges lawmakers to implement contentious Basel III model constraints

Enria takes aim at eurozone banks’ sovereign exposures

New ECB supervision chair floats Pillar 2 concentration charge, criticises use of IFRS 9

No bank would benefit from planned eurozone G-Sib waiver

Neither Deutsche nor BNP Paribas would move to a lower capital buffer, based on end-2017 data

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

What’s Finnish for ‘too big to fail’?

Strange case of Nordea highlights flaw in G-Sib assessments

National supervisors put pressure on global risk models

Varied supervisory and external audit demands stretch cross-border risk management