Risk management

Evaluating cyclic risk propagation through an organization

Many large organizations have risk that propagates because of the dependencies between their various major organizational components. This paper addresses when cycles of dependencies exist in an organization or system of systems.

Managing commodity risk in turbulent times

Faced with today’s razor-thin margins, firms must be able to monitor all risks holistically, in real time and to hedge effectively. This brings technological challenges, and many firms are now grappling with issues such as getting the right datasets,…

Concentration in cleared derivatives: the case for broadening access to direct central counterparty clearing

In this paper, the authors explore the benefits and challenges of encouraging major end-users of derivatives to become direct clearing members of central counterparties (CCPs).

Future-proofing fraud prevention in digital channels

How financial institutions are future-proofing fraud detection in digital channels, their approaches and considerations in building digital access and growth while balancing fraud management.

OCC warns on cyber and fraud control lapses during Covid

OpRisk North America: Covid-induced changes in operations and working practices creating openings for bad actors, says senior regulator

What buy-side risk professionals can learn from the Covid‑19 crisis

The lessons learned from the pandemic so far, and how risk professionals are continuing to manage risks as the Covid-19 situation remains untamed.

Back to school: BlackRock uses quant quake lessons on Covid

Pandemic prompts a switch in approach from strategic to tactical

Europe’s clampdown on fund outsourcing chills market

Esma proposals spark worries AIFMD review could wreck existing delegation models

Rent-a-fund managers rebuff ‘misguided’ Esma criticism

Europe regulator warns of conflicts of interest between risk and portfolio managers in AIFMD delegation model

Banks welcome US overhaul of AML rules

Proposals signal shift to risk-based approach to financial crime detection

Risk model management in the age of Covid‑19

As many financial institutions acknowledge that risk models designed prior to the Covid‑19 crisis cannot effectively assess the current climate, it is apparent that current methodology needs an upgrade to sufficiently distinguish the effects of the…

Bank risk manager of the year: Marita Socorro Gayares, Bank of the Philippine Islands

Asia Risk Awards 2020

The impact of corporate social and environmental performance on credit rating prediction: North America versus Europe

The authors quantify the extent to which the quality of credit rating predictions improves by integrating measures of corporate social performance (CSP) in an established credit risk model. Their analysis provides comprehensive evidence of the…

Bank of the year, Thailand: CIMB Thai Bank

Asia Risk Awards 2020

Market risk management product of the year: FIS

Asia Risk Technology Awards 2020

How financial Institutions can manage risk for business recovery

Hosted by Asia Risk, this webinar – ahead of this October's Risk Hong Kong conference – addresses the latest market trends and challenges faced by Hong Kong’s risk management practitioners

The top risk management trends in the Asean region

Setting the scene in preparation for the Risk Asean conference in October, a group of industry experts debate and discuss the top trends in risk management the Asean region will need to look out for in 2021 and beyond

Revised FRTB deadline poses further challenges for Asia‑Pacific banks

Essan Soobratty, product manager for regulatory data, New York; Eugene Stern, global head of product, market risk, New York; and Vicky Cheng, head of government and regulatory affairs, Asia‑Pacific, Hong Kong, at Bloomberg explore the additional…

The changing shape of buy-side risk technology

Buy-side risk managers and FactSet’s global head of quantitative analytics gathered for a Risk.net webinar to discuss topical risk management trends for asset managers and to consider the industry challenges posed by the recent Covid‑19 pandemic

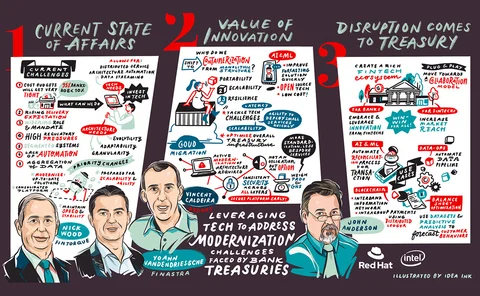

Leveraging technology to address modernisation challenges faced by bank treasuries

Bank treasurers and technologists convened for a Risk.net webinar in association with Red Hat to consider how technological innovation could help treasury functions meet rising expectations

Lessons from the past – The evolving importance of historical tick data (Part I)

A recent Risk.net webinar in association with Refinitiv examined the opportunities and challenges for using historical tick data in today’s volatile markets. Panellists outlined the variety of ways the industry is harnessing historical tick data, but…

Inside the Fed’s secret liquidity stress tests

Lobbyists and Quarles train sights on horizontal exams that can shape bank risk appetite

Op risk data: Goldman 1MDB settlement swells 2020 loss tally

Also: Deutsche fined over Epstein KYC failings; collateral fraud in focus. Data by ORX News

Managing financial risk in cross-border emerging markets M&A

BNP Paribas’ Djamel Bruimaud, strategic sales lead for foreign exchange and local markets for European corporates, and Stephane Benhamou, head of forex and rates solutions sales, France, discuss the creation and execution of a hedging solution designed…