This article was paid for by a contributing third party.More Information.

Lessons from the past – The evolving importance of historical tick data (Part I)

A recent Risk.net webinar in association with Refinitiv examined the opportunities and challenges for using historical tick data in today’s volatile markets. Panellists outlined the variety of ways the industry is harnessing historical tick data, but also spoke about some of the challenges faced by financial firms

Evolution of historical tick data

Financial institutions (FIs) have long appreciated the benefits of robust and reliable historical data and its ability to inform and improve decision-making. Yet the usage of tick data remains an ‘evolving science’. Banks and asset managers are increasingly focused on the insights that can be derived, and are exploring the best ways of using and gathering such datasets.

David Ng, chief operating officer for CSOP Asset Management, explained that asset managers have traditionally used historical tick data in the development and execution of investment and alpha strategies. “We use it very extensively,” he said. However, he has recently seen alternative uses emerging. “I think the most obvious areas are compliance and surveillance,” he added, “particularly in light of the changing regulatory climate and ever-increasing regulatory demands that have been placed on financial services firms.”

Vinay Srinivas, head of Asia-Pacific global markets quant analytics and digital transformation for UBS, agreed historical tick data use is now widespread across the industry and is employed in a variety of ways; from building and backtesting investment strategies and short-term alpha factors through to execution strategies. Srinivas has seen a big uptake in the industry for tick-history usage in calibrating algorithms and setting parameters. He also noted that “market surveillance is always going to be a big thing, especially with the regulatory constraints that banks have.”

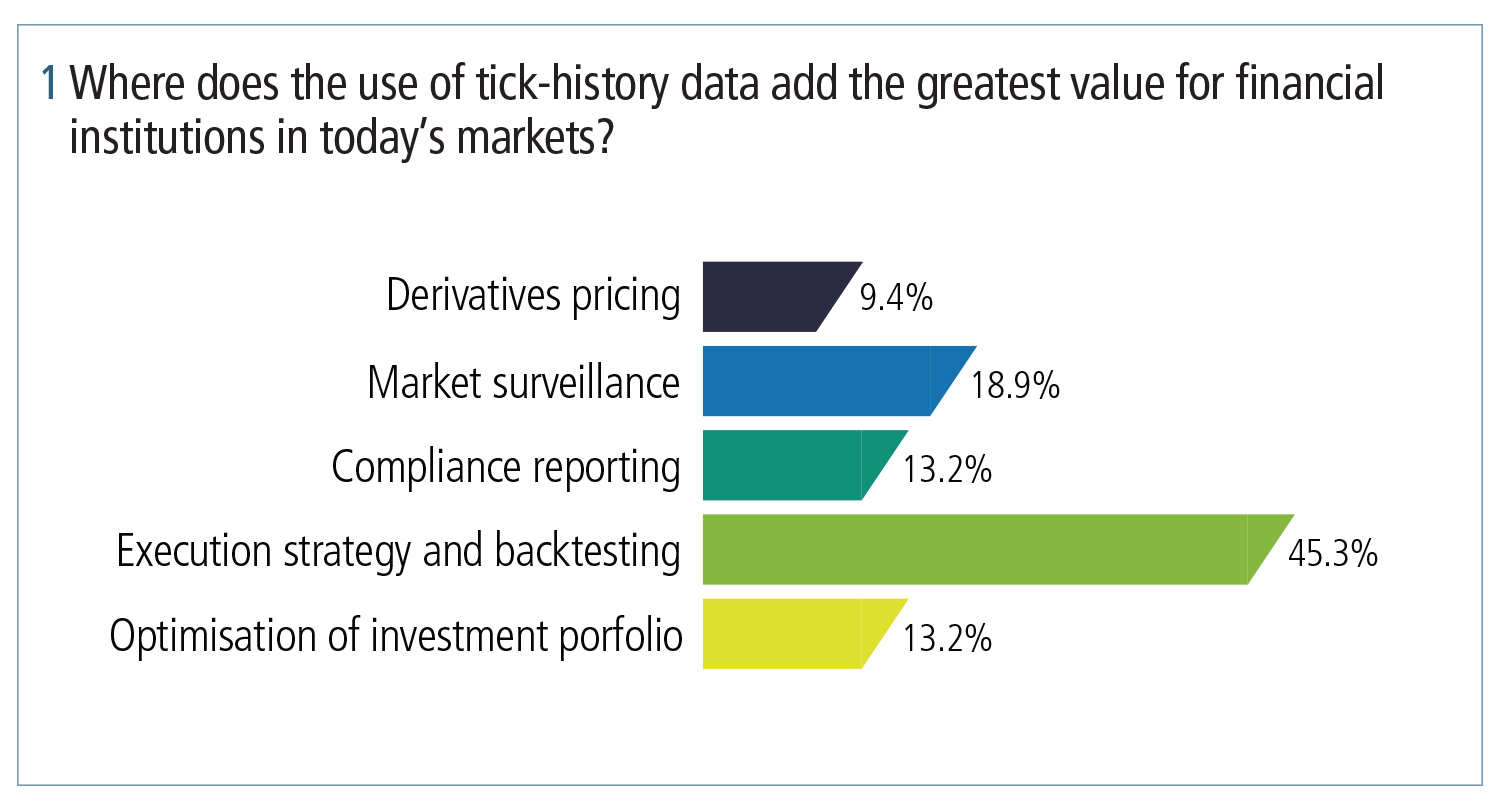

Responses to an audience polling question further supported the fact that historical tick data adds value across different areas of the business. While 45% of attendees felt that tick-history data adds the greatest value in execution strategy and backtesting, there was a broad split among the remaining responses, including market surveillance, compliance reporting and optimisation of investment portfolios.

Managing current market volatility

Tick data is also proving to be a valuable starting point for assessing and managing current market volatility. Quants and developers are increasingly using historical tick data to backtest trading strategies, examining how they would have performed in previous periods of volatility to inform and define their current and future strategies.

Srinivas explained that “the movement we have seen recently is fairly different to what we have seen in the past, even from 2007 and 2008, [but] you still need to start with and use the tick history.” He underlined it is only one of many datasets that FIs are currently using, and highlighted the importance of also testing other extreme scenarios from a control perspective. But Srinivas believes the industry is using tick history a lot more aggressively now, as a result of current market conditions.

David Ng agreed, commenting that, while you still need the experience of traders and investment managers, tick history provides a very good proxy. He outlined recent liquidity stress tests that his company had conducted, using historical datasets from the global financial crisis as an example of how historical tick data can help.

New opportunities

It is clear that tick-history datasets play an increasingly important role across both the front and middle office. Tick data can provide a trustworthy and reliable resource in helping with alpha-seeking quantitative analysis, backtesting trading strategies, transaction cost analysis, risk management, compliance reporting activities, and more.

Srinivas noted that the number of tools built on historical tick data is “expanding by the day”, while Catalina Vazquez, historical data proposition director at Refinitiv, suggested the paradigm is changing, with the availability of tools such as Google’s Big Query opening up opportunities that were simply not possible a few years ago.

With the benefits of a growing number of tools and cloud-based solutions available to FIs (which are examined in the second of this series), there will undoubtedly be many exciting developments in the use of tick-history data going forward.

This is the first in a series of articles exploring the themes discussed during the session. The second is available here.

Listen to the Risk.net webinar Lessons from the past – Utilising historical data and technology to assess market volatility

About Refinitiv

Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving more than 40,000 institutions in approximately 190 countries. It provides leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community – driving performance in trading, investment, wealth management, regulatory compliance, market data management, enterprise risk and fighting financial crime.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net