Risk factors

Building forward-looking scenarios: why you’re doing it wrong

Rick Bookstaber and colleagues describe a process for constructing effective scenarios

How algos are helping inflation-wary investors

Buy-siders look to machine learning for clues on the effect of rising prices on portfolios

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Goldman inks modelling, data tie-up with MSCI

Move to cross-sell risk analytics could herald further content deals for bank’s Marquee platform, says sales chief

Solving final value problems with deep learning

Pricing vanilla and exotic options with a deep learning approach for PDEs

Approaching the endgame – What’s left for completing Libor transition?

Philip Whitehurst, head of service development, rates at LCH, discusses the International Swaps and Derivatives Association’s 2020 Ibor fallbacks protocol, its relevance for cleared swaps, remaining transition steps and major developments to look out for…

Indexed for growth – The democratisation of thematic indexes

Simon Karaban, head of index services at Singapore Exchange, talks about environmental, social and governance indexes and how the emergence of exchange-traded funds and wealth platforms is democratising thematic indexes, making them more accessible to…

Covid scenarios, pt II: apocalypse how?

Second crowdsourced scenario exercise reveals polarised views in equities and FX

EBA relaxes modellability hurdles for market risk capital

Flexibility granted for assessing NMRFs on options, but constraints remain on committed quotes

The Fundamentals of market risk rules

With the 2022 Fundamental Review of the Trading Book (FRTB) deadline looming, banks are fast coming to grips with the amount of work still to be done to achieve a successful implementation

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

FRTB costs force banks to weigh IMA desk by desk

Risk USA: Some desks “may not be able to pass these more rigorous standards”, says Morgan Stanley FRTB lead

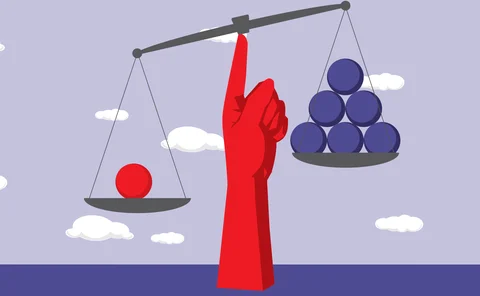

FVA – Time to go asymmetric?

Despite being introduced over six years ago, there is still no market consensus on how to calculate funding valuation adjustments. One point of contention is whether to use the same funding curve for borrowing and lending (symmetric funding) or to use…

2022 – A market risk odyssey

Though January’s final version of FRTB offered no great surprises to those who have followed the regulation since its inception, banks now have a greater idea of what is required of them. Bloomberg explores the importance for banks to have FRTB…

Risk and finance – Better together

Changing regulations and new accounting standards are creating enormous challenges for financial organisations. Thorsten Hein, principal product marketing manager, risk research and quantitative solutions at SAS, explores why, to successfully meet these…

One size does not fit all – Adapting to meet investment goals

Guillaume Arnaud, global head of quantitative investment strategies (QIS), and Sandrine Ungari, head of cross-asset quantitative research at Societe Generale, explore the benefits of QIS for investors, why flexibility is crucial for investors to meet…

A helping hand – Addressing industry concerns

The Basel Committee on Banking Supervision’s final revisions to the FRTB guidelines aim to address industry concerns around complexity and capital implications. A forum of industry leaders discusses whether the changes have been effective and how banks…

Turning the IMA into a competitive advantage

Following the clarification of the FRTB rules in January 2019, financial institutions are now working towards a 2022 implementation deadline, finalising how their trading books will operate under this demanding regulation. Eoin Ó Ceallacháin, head of…

Cleaning noisy data ‘almost 70%’ of machine learning labour

Quants flag signal-to-noise ratio as key to reducing overfitting risk

FRTB: Singapore’s banks eye internal models for forex desks

New market risk regime dangles capital savings for own-models approach

Natixis creates model to ‘learn’ how factors interact

Random forest technique sheds light on flux in how factors mix, manager says