Pension funds

Super plans

Super plans

Sponsored statement: Royal Bank of Scotland

Liquidity – a new asset class? New opportunities for insurance and pension funds

AK Asset Management's Turkish delight

Turkish delight

LGIMA adds Veerman as pensions specialist

LGIMA adds Veerman as pensions specialist

Unrealistic pricing expectations impede development of longevity swap market

Price expectations have played a crucial role for the relatively small number of longevity swap deals that have so far been completed

Longevity swaps and the bulk purchase annuity market: Video interview with Simon Gadd, Legal & General’s head of annuities

Longevity swaps have yet to move into the mainstream – but bulk buyouts could be set return to favour

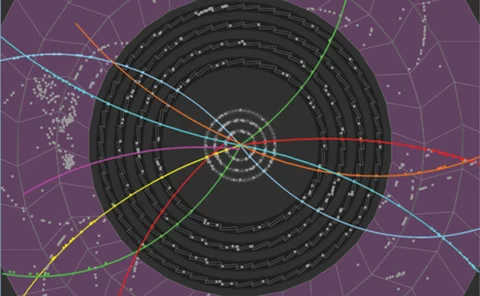

Dutch pension funds take lead in LDI implementation

Survey indicates Dutch pension funds have all opted for LDI

Agrica profile – risk managing SRI

Responsible change

Germany - liability-driven investment goes mainstream

Time for change

Life settlements – too good to be true?

Too good to be true?

US public pension deficits driving muni yields

Untied states

Insurers weigh the pros and cons of total return swaps

Many happy returns

Retirement of baby boomer generation heralds shift to fixed income

Baby boom, baby bust

Cern pension fund – moving beyond LDI

Frontiers of funding

Pension funds worried about CCP margin

Margin hunters

Asset swaps continue to support inflation market

Linking to new sources of inflation

Cash variation margin requirements worry pension funds

Having to post cash as variation margin to central counterparties (CCPs) will cause substantial yield losses for pension funds that conduct liability-driven investment (LDI) strategies, according to fund managers.

Botched legal work in BT privatisation responsible for potential £23 billion pension liability for UK taxpayers

Flawed legal agreement behind landmark UK privatisation leaves UK taxpayers counting the cost

UK’s TPR issues FSD on Lehman Brothers

The Pension Regulator takes a tough line with Lehman Brother creditors over UK pension fund deficit

Scor eyes UK pension funds’ longevity risk

Reinsurer Scor becomes the latest firm to enter the longevity arena

Pimco’s Andrew Balls talks about the European sovereign debt crisis

Balls says support packages "might just provide the opportunity for conservative investors to get out"

Danish pension funds hit out at cross-subsidy regulation

PKA and Sampension say cross-subsidy regulation threatens Danish pension system

Uncertain outcomes – insurers and pension funds tackle inflation risk

With central banks’ discount windows pouring money out at rock-bottom rates but economies still slow to use up excess capacity, the outlook for inflation has never been murkier. Uncertainty has created arbitrage opportunities for inflation risk managers…