Netting

Banks take flexible approach to pricing netting risks

Dealers are adjusting CVA prices, depending on their view of the legal netting opinion

Netting risks create pricing and operational headaches

Oversight of legal risks is not always robust

Accounting puts brake on move to daily settled swaps

New margin approach threatens hedge accounting status, could hurt effectiveness

Energy firms urge EC to ease Emir clearing rules

Review highlights concerns over impact of clearing on nonfinancials

Proposed margin rule to hurt global banks’ trades with China

Industry dislikes HKMA rule on initial margin for uncleared trades with non-netting countries

Interoperability between central counterparties

The authors investigate interoperability from the perspective of the multilateral netting property of central clearing.

Global banks support 5% threshold for margining uncleared swaps

A lack of netting statutes and low volumes make requirements excessive for emerging markets

Russia to de-link derivatives reporting and netting

Corporates may be drawn into reporting regime, however

India to become netting friendly on bankruptcy law reform

Different treatment of public and private banks stymied netting – but this could now change

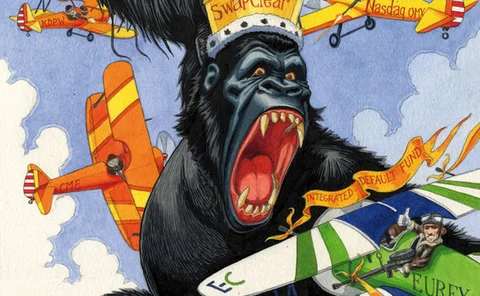

Eurex vs LCH.Clearnet: clash of the titans

German exchange woos big clearing members with promise of capital savings

Banks call for CCPs to act on compression

Revamped service at LCH.Clearnet has $200 trillion target for 2014

China still a 'dirty' netting jurisdiction for banks

Lack of certainty over close-out netting continues in China

Legal clouds hang over RWA-driven netting push

New capital requirements are making it more difficult for banks to trade with counterparties that are not covered by a netting opinion. That is spurring attempts to expand coverage, but can leave banks and lawyers on uncertain ground. By Lukas Becker

UniCredit hit by ‘dangerous’ ruling in Russian swap dispute

Court sets "dangerous precedent" in allowing local corporate to walk away from swap without compensating UniCredit

Central clearing obligations cause collateral headaches in Asia

Collateral thinking

South Africa considers onshore mandate for OTC clearing

On-message for onshore clearing?

Lack of clarity over clearing provides problems for Asia banks

The deadline set by the G-20 to clear all standardised OTC derivatives has passed but a lack of regulatory clarity over the shape of reform is hampering banks in the region

Asia Risk Congress: Clarity needed on close-out netting

Panellists at Asia Risk Congress say there needs to be clarity on close-out netting in certain countries before establishing CCPs

IMF: CCP structure increases systemic risk

The likely increase in the number of central counterparties will create more 'pockets of risk', says senior economist

Diverse netting approaches create OTC headache

Gap in the net

Banks hope for CCP capital concessions at Basel meeting

Banks and CCPs are pressing for changes to method of calculating default fund capital

Dealers pitch loan format for swaps as CVA dodge

Banks are offering to replicate the economics of OTC swaps in loan format - avoiding new capital and clearing rules

Mitigating op risks for CCPs post-crisis

To the rescue