Mortgages

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

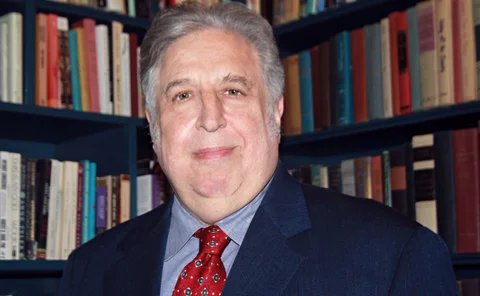

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Chafing under capital rules, JP Morgan sells home loans

Standardised risk weights for residential mortgages far exceed modelled equivalents

Q&A: CFTC’s Behnam on tackling market risk in climate change

Commissioner wants to see new derivatives products to help mitigate climate threat

In hunt for yield, US insurers turn to illiquid assets

Mortgage exposures grow 72% in eight years since 2010

US Bancorp slashes bad assets 5% in Q2

Total amount of toxic assets stood at $953 million at end-June

Stress test projected loan losses fall $18bn

Credit card loss rates account for 36.3% of total loan losses under severely adverse scenario

Now under aegis of ECB, Nordea RWAs spike 29%

Imposition of Swedish mortgage floor adds €10.6 billion of risk-weighted assets alone

Metro Bank loan blunder perplexes industry

Bankers surprised risk-weight errors went unnoticed, warn they could harm bank’s IRB aspirations

Loan losses bedevil Lloyds in EU stress tests

UK bank saw largest CET1 decline due to asset impairment of EU-wide sample

Model changes threaten 30% rise in Nordea's RWAs

Imposition of new risk weight floors will harm bank's capital ratio

Ibor transition valuation and risk management considerations

The impending move from interbank offered rates to alternate reference rates will require important changes to many valuation and risk management processes and infrastructure. EY Financial Services’ Shankar Mukherjee, Michael Sheptin and John Boyle…

Procyclicality of capital and portfolio segmentation in the advanced internal ratings-based framework: an application to mortgage portfolios

This paper investigates the procyclicality of capital in the advanced internal ratings based (A-IRB) Basel approach for retail portfolios, and identifies the fundamental assumptions required for stable A-IRB risk weights over the economic cycle.

Mortgage add-on elevates ING credit risk

Credit RWAs up 4.2% on loan growth and Belgian regulator-set multiplier

Consumer risk appetite, the credit cycle and the housing bubble

In this paper, we explore the role of consumer risk appetite in the initiation of credit cycles and as an early trigger of the US mortgage crisis.

UniCredit sheds €10.5 billion in toxic loans

Net write-downs on all loans fell to €496 million in the quarter, down from €835 million in December, an improvement of 40%, as a result of improved asset quality

NAB model change boosts mortgage RWAs

Residential mortgage RWAs leap A$10.6 billion

RBS model change loads on credit RWAs

RBS's total RWAs increase for the first time since 2015

Libor death threatens to blow hole in hedges

Isda AGM: BlackRock, Fed stress need for fallbacks to marry up across rates universe

UBS warns of 6% increase in credit RWAs in 2018

The bank's credit RWAs continue upward trend

BAML approaches Collins floor

The gap between RWAs calculated under the two approaches continues to shrink

Power to the people: US bourse bets on retail rush into swaps

Eris Exchange hopes retail access to its swap futures will usher in new era of swaps for all