Model validation

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Want to be a quant? Here’s how (and how not) to get hired

Stay curious, be a team player, speak well – and don’t be big-headed

For tomorrow’s quants, Python is essential; AI isn’t

Proportion of PhDs in quant teams is sliding, as employers focus on all-round skills

An aggregated metrics framework for multicriteria model validation using rolling origin evaluation

The authors apply the rolling origin evaluation framework to model validation in multicriteria settings, where performance must be assessed through various scenarios or forecast targets.

Probabilistic classification with discriminative and generative models: credit-scoring application

The author investigates how probabilistic classification can be used to enhance credit-scoring accuracy, offering a robust means for assessing model performance under various reliability criteria

A comprehensive explainable approach for imbalanced financial distress prediction

The authors suggest an explainable machine learning method for imbalanced financial distress prediction which uses extreme gradient boosting.

Speedy onboarding: the push for faster model approvals

Europe’s banking watchdog is planning to streamline how it authorises credit model updates. Not a moment too soon, say bankers

Generative AI brings testing times for modellers

Flagstar’s lead model validator offers some tips for safely integrating LLMs into risk models

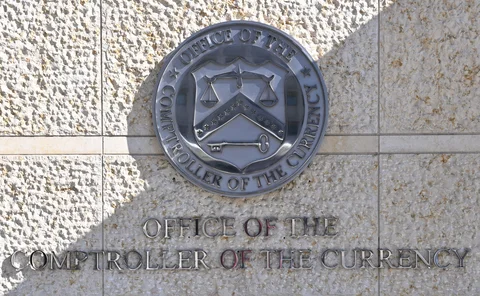

Brain drain at OCC raises concerns about US model supervision

Quant team cull will reduce capacity to validate bank models, but that could be part of the plan

Model risk quantification for machine learning models in credit risk

This paper analyses bank-specific model risk measurement methods with a focus on implemented model risk rating solutions for MLMs and discusses challenges faced by the validation function.

AI shows cognitive bias just like humans, tests show

Risk Live: New form of op risk may be “especially dangerous” for model validators, quant says

A three-stage fusion model for predicting financial distress considering semantic and sentiment information

The authors apply sentiment analysis to management discussion and analysis texts to aid the prediction of financial distress with an innovative three-phase fusion model.

Emir rule delay leaves Simm paperwork gathering dust

Mid-year refresh triggers Emir 3.0 authorisation process despite unfinished regulatory standards

JP Morgan’s VAR limits blown twice during haywire Q1

Breaches add to the two regulatory backtesting exceptions sustained the previous quarter

DeepSeek success spurs banks to consider do-it-yourself AI

Chinese LLM resets price tag for in-house systems – and could also nudge banks towards open-source models

Industry fears Emir 3.0 fast model approval will cause delays

More model changes could be caught by proposed criteria for defining significance

How Citi moved GenAI from firm-wide ban to internal roll-out

Bank adopted three specific inward-facing use cases with a unified framework behind them

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

The impact of deterioration in rating-model discriminatory power on expected losses

The authors propose a means to estimate the effects on a portfolio’s expected credit loss created by underwriting model risks.

US banks seek to open vendors’ black box on green data

Inaugural Fed climate scenario analysis flags lack of transparency around third-party models

A study of China’s financial market risks in the context of Covid-19, based on a rolling generalized autoregressive score model using the asymmetric Laplace distribution

The authors construct a risk measurement model for the financial market during the Covid-19 pandemic, using data from the Shanghai Stock Exchange for empirical analysis.