Margin

OCC margin breaches spike in Q1

Peak exposure of $363 million in three months to March 31

CME reports two margin breaches in Q1

Shortfalls totalling $79 million were by far the largest for the CCP since public reporting started in 2015

Citi fastest growing FCM; Credit Suisse loses ground – CFTC data

Citi grows client margin 36% in year to end-April, Credit Suisse shrinks 16%

G-Sib swap portfolios reveal transatlantic divide

EU banks record 16% fall in non-cleared swaps, while US dealers see 9% growth

CCPs must step up cyber risk efforts, says EU legislator

Policymakers want more focus on non-default loss resources; Eurex Clearing’s Mueller flags investment risk

CCPs incur fewer margin breaches in 2017

LCH Ltd reports 399 fewer breaches than in 2016; DTCC 156

Esma questions CCP ‘free ride’ for sovereigns

Regulator has asked EC to take a stance on venues that let public entities clear without posting margin

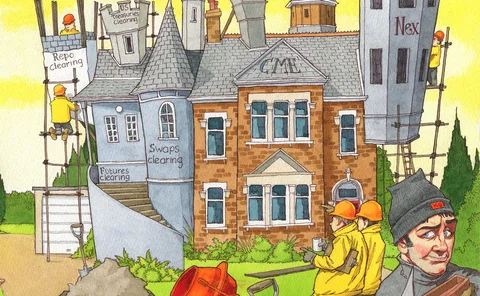

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

CFTC, Treasury officials boost Isda push for IM revamp

Isda AGM: Research paid for by trade body calls for variable MPOR

Fed discussing margin impact of SOFR switch

Isda AGM: Legacy Libor swaps should be protected from new rules when ditching Libor, MetLife’s Manske says

Swaps market off pace for IM rules – Isda survey

Participants want to see more standardisation in collateral and custodial contracts

The rapid evolution of compression: Keeping pace with optimisation activity

Sponsored forum: Capitalab

JSCC margin changes ease Japan interest rate pain

Negative rates prompted switch in the CCP’s margin calculation model for interest rate swaps

FCMs warn CCPs not to compete on margin

Equity moves in February exceeded margin posted against some cleared products

European legislators to exempt CCPs from new bank rules

Support in Council and Parliament suggests leverage ratio, NSFR exemptions will be in final text

VM rules sound death knell for forex swaps in Europe

Market participants claim instrument was a “mythical creature” that never really existed

Clearing conundrum – Forging a solution for the bilateral market

Central clearing has had a beneficial effect on the over‑the‑counter derivatives market, but for some products the road to a cleared model has not been smooth. Capital, operational and margin costs of the non-cleared market have increased, while…

Derivatives close-out netting nears approval in India

Legislation expected early next year will clarify that local banks can use technique, say lawyers

Asset manager of the year, risk management: Legal & General Investment Management

Risk Awards 2018: LGIM led on inflation e-trading, margin rules prep

FCA: buy side can stop work on VM rules for forwards

UK regulator follows up on statement from ESAs that urged forbearance

Goldman swaps assets drop $140bn after margin change

Move follows guidance from US regulators; no word from Goldman on capital impact