Macroeconomics

Eurozone crisis to have limited impact on southeast Asia – Asean Risk 2012

Resilience in regional markets will insulate Asian nations from any European slowdown, say economists during Asean Risk 2012 roundtable

Parala Capital launches 'index of indexes' in conjunction with Dow Jones Indexes

Macro strategy boutique Parala Capital has signed its first index deal with Dow Jones Indexes

Why the West can’t bank on China this time round

China concerns

Banks turn to dynamic algorithm-based structures to exploit interest rate cycles

Demand for fixed-income dynamic interest rate strategies that combine short-term algorithms and long-term positions on interest rate futures is slowly returning

Stockton retires from FRB

David Stockton will be retiring from the FRB ths year after 30 years of service

The power of defunct economists

The power of defunct economists

Nouriel Roubini interview: Fixing the Eurozone will be 'mission impossible'

In an interview with Credit, economist Nouriel Roubini talks about the danger that sub-par US and European growth becomes entrenched, and offers his views on whether Ireland and other peripheral Eurozone countries will be able to solve their debt woes

Growth in Bric nations may not help global economy

Growth in Bric nations may not help global economy

Advanced economies risk slipping into Japan-style 'lost decade'

Lessons from the lost decade

Stick with government bonds – even if they are overpriced: Andrew Dalton profile

All about the assets: Andrew Dalton profile

Equities may have reached nadir - BlackRock's Doll

Commodity price increases may indicate improved economic prospects

West must not repeat Japan’s fiscal mistakes, says Nomura economist

Nomura chief economist Richard Koo warns the US and European economies face double-dip recession and a prolonged period of economic stagnation if stimulus is cut too soon.

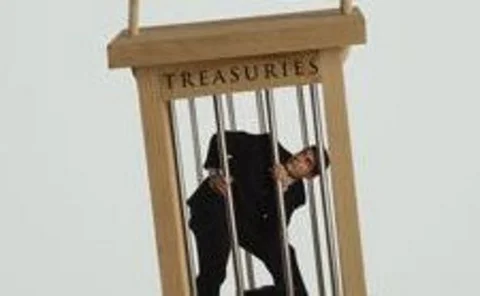

Global economic imbalances may lead to 'bond trap' for investors

US-led efforts to rebalance the global economy are in danger of foundering on Europe’s fiscal retrenchment drive. The result, warn economists, may be a global bond trap, whereby surplus liquidity is channelled into safe government debt, freezing…

Credit Institute event: The outlook for high yield

June’s meeting of Credit Institute gave investors the opportunity to discuss the key themes affecting the high yield market, including the Eurozone sovereign crisis and refinancing risk.

Are US and Europe's economies at the point of divergence?

Strengthening fundamentals in the US and continued uncertainty over peripheral European economies have given rise to the notion that the US and Europe are undergoing a decoupling process. Credit looks at what this may mean for the US government bond and…

US Treasury yield movements betray deflation danger

Inflation often accompanies the end of the recovery after a crisis, but while US companies may fear high inflation, banks and investors increasingly see deflation as the more serious risk to the US economy.

Economists fear 'global bond trap'

Economists warn fiscal belt-tightening in Europe may exacerbate imbalances in the global economy, leading to sluggish growth and excess liquidity in government bonds.

China to revalue renminbi ‘by 4-5%’ this year: Zhang Wei profile

The Chinese Communist Party’s former leading economist, Zhang Wei, explains how revaluing the renminbi is in China’s interests, why the financial markets are such a headache for the country’s leaders and how the new generation may yet prove to be the…

BIS outlines 'narrow path ahead' in annual report

Daily news headlines

Japan and EU meet for high-level talks

Daily news headlines