Liquidity

Q&A: Myron Scholes on LTCM, crisis lessons and the value of intermediation

Quants' golden age

CVA's cousin: Dealers try to value early termination clauses

Adjustment anxiety

Basel III liquidity rules shaking up the corporate deposit market

Deposit(ive) thinking

Regulators wary of new corporate deposits that sit outside Basel III LCR

Basel III arms race begins with product that uses a rolling, embedded option to keep deposits outside bounds of new liquidity ratio

Interbank settlements: the cash must flow

The cash must flow

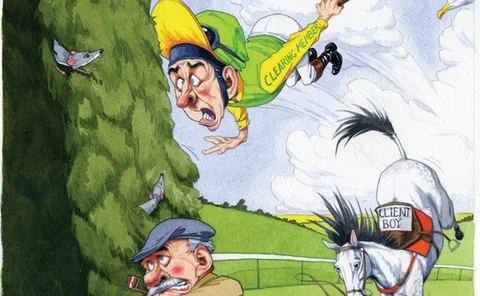

Risk waterfall at CME, Ice makes porting harder, dealers say

The need to provide portability could pressure CCPs to lean more heavily on initial margin than default funds to absorb losses

Ignoring the perils of portability

The perils of portability

The product no-one wants to sell: portability held up by lack of rules

Under-the-counter derivatives

Q&A: ACP's Nouy on CRD IV, equity in the LCR and CoCos

Behind Basel III

Capital One: banking on banking

Capital gains

Comment: Mario Draghi, governor of the Bank of Italy

Incoming president of the European Central Bank warns against pressure to water down regulatory reform, in this edited version of a foreward to a new Risk book

EC's CRD IV says dealers can ignore portability risks

While Basel Committee deliberates, EC proposes 'value of zero' for contingent risks associated with clearing portability

Forex options clearing complicated by guaranteed settlement requirements

CPSS-Iosco guaranteed settlement requirements make foreign exchange options clearing more difficult, say participants

Collateral transformation needs to be carefully planned by clearing members, says Isda’s O’Connor

In an exclusive video interview, Isda chairman Stephen O’Connor says there is a finite capacity for clearing members to provide collateral transformation services to their clients

Further liquidity fragmentation in foreign exchange predicted

Market-damaging behaviour should be controlled, but separation or elimination of high-frequency trading would be damaging to the market’s equilibrium, ClientKnowledge argues in research published today

Banks call for equity to be counted in LCR

A taste for diversification

Client clearing poses acute liquidity risks

Margin jump risk

Equity should be included in LCR – Risk.net poll

Equity should be included in Basel III liquidity coverage ratio, say respondents

GFI Group, Inc.

The secret to being a leading wholesale broker is to be a whole lot more.

Assessing the arguments against shorting

Assessing the arguments against shorting

Chi-East moves to connect Asia's dark pools

Joint venture between Singapore Exchange and Chi-X Global expects to announce four new members in the next two months

LCR should include equity, says ACP’s Nouy

Basel III liquidity coverage ratio should admit equities with significant haircuts, says Danièle Nouy at the Autorité de Contrôle Prudentiel

Basel III liquidity rules won't be watered down in Europe, says ACP's Nouy

Autorité de Contrôle Prudentiel secretary-general Danièle Nouy says looser language in the CRD IV draft won't ultimately mean weak rules in Europe

Basel Committee continues to reject equity for the LCR

Equities do not have the necessary characteristics to be included in the liquidity coverage ratio, says general secretary Stefan Walter – but some banks disagree