Indexes

IBA rolls out Sonia indexes for lending markets

Alternative to BoE index includes 0% floors and support for both lag and shift conventions

Quants say they can fix value’s broken ratio

Price-to-book metric can be tailored to the new economy, researchers believe

EU fund managers confused by new ESG designations

Vague rules leave managers unsure which categories to apply to their funds

Libor transition – What is the endgame?

No-one expected the transition away from Libor to be easy. At the outset, some doubted whether the transition was even possible. However, with less than a year left before the expected cessation of Libor as a regulated benchmark, the transition certainly…

Haitong set for warrants wins as China sanctions hit US banks

China securities firm doubles HKEX warrant output as US banks pull listed products on vetoed names

Bloomberg joins race for SOFR credit add-on

Benchmark provider building bolt-on adjustment from short-term bank lending data

Credit Suisse bets on intraday vol signals to revive FIA sales

New line of fixed indexed annuities will use intraday data for more precise vol targeting

New HKEX warrant buyers surf vol in unfamiliar waters

While stock volatility is boosting inline warrant turnover, it’s driving bets more suited to wholesale products

FX swap volumes set to rise on China bond index inclusion

Traders expect greater use of FX derivatives if FTSE Russell adds bonds to WGBI this week

Index provider of the year: MSCI

Asia Risk Awards 2020

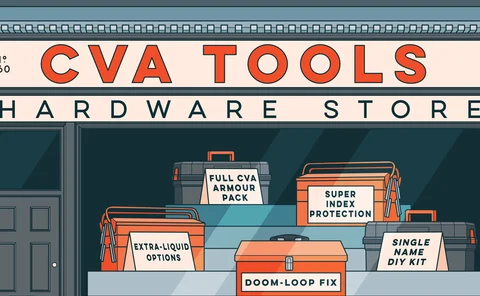

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

China Minsheng Bank MStar shines in volatile markets

Sponsored content

Stanford’s Duffie shakes up SOFR credit race with AXI index

Academics propose new credit index that ditches Libor tenors for a single funding spread

Markit plans SOFR credit spread add-on using CDS data

Vendor taps vast pool of credit market data to create new benchmark “not dissimilar” to Libor

Bond managers relaxed ahead of bumper index rebalance

Fed’s credit facilities boost confidence as downgrades hit corporate bond indexes

When are index delays justified? Industry standards are vital

Relying on discretion is not sustainable, argues index executive in wake of rebalance delays

Left out of Fed action, lower-rated CMBS overheat

BBB yield-to-worst spirals as highly-rated bonds recover after central bank and government intervention

Index delays leave passive bond funds in purgatory

Moves to postpone index rebalancings could backfire as rating agencies press ahead with downgrades

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

Dispersion trades suffer in coronavirus selloff

Losses put at roughly $150m – even before markets tanked on March 9

Exploring new investment prospects in volatile markets

Custom and traditional proprietary indexes have been growing in popularity and actively transforming the investment landscape. Financial products linked to indexes are thriving, enabling more efficient access to the market, whether it is equity, bonds or…

Exchange innovation of the year: CME Group

Risk Awards 2020: New equity index contracts most successful launch in exchange’s history

JP Morgan debuts Nexus spinoff for hedge fund exposure

Bank launches matchmaking service for lonely hedge funds and return-hungry investors

Quants clone private equity: pale imitation or real deal?

Theory says replication can work, but investors are reluctant to give up private equity’s smoothed returns