Illiquid

Op risk data: 1MDB scandal still haunts Wall Street

Also: Woodford in hot water, Salesforce voice phishing hooks multiple firms. Data by ORX News

Filling gaps in market data with optimal transport

Julius Baer quant proposes novel way to generate accurate prices for illiquid maturities

FRTB managers face hard facts about risk factors

There are ways to reduce the capital charges caused by NMRFs, but they come at a price

Run risk on funds not a systemic issue, say market participants

FSB and Iosco are consulting on drive to make open-ended funds adopt anti-dilution tools

Relief (and some regret) as EU scales back swaps transparency

Leaked document outlines plans to narrow scope of dysfunctional OTC disclosure regime

EU’s late CDS transparency push triggers trader fears

Leaked proposal to shoehorn public disclosure of CDS into Mifir placates Esma, but alarms traders

A new approach to marking volatility of illiquid options

Julius Baer quant’s arbitrage-free solution overcomes challenge of sparse data

UBS cuts liquidity valuation adjustments to record low

Bank lowered bid-offer fair value discount to reflect current levels of market liquidity

Illiquid assets throw UK pensions off balance

Collapse in equity and bond prices leaves some funds with outsized exposure to private holdings

Shifting rates throw bond investors off balance

Dearth of bond liquidity forces some traders to offload positions – but, as ever, others are waiting to pounce

Mutual funds struggle to value Russian bonds

Filings show just how challenging pricing securities has been during crisis

A look at asset liquidation from a different angle

Quants propose a novel approach to assess liquidation cost and stress-testing for hard-to-sell assets

Regulators need to go back to fundamentals on fund risks

Policy-makers need to identify risks posed by open-ended investment funds more precisely

US rate caps under strain amid volatility surge

Market uncertainty hits liquidity in options on swaps, dealers say

Level 3 assets at global systemic banks down 36% since 2014

Hard-to-value holdings down sharply over the past six years, but pandemic threw spanner in the works at some banks

The effects of transaction costs and illiquidity on the prices of volatility derivatives

This paper employs a PDE approach to price several volatility derivatives under different transaction costs and illiquidity models.

What drives the January seasonality in the illiquidity premium? Evidence from international stock markets

This study is, to the best of the authors’ knowledge, the first attempt to comprehensively examine and explain the January effect in the illiquidity premium.

Machine learning will create new sales-bots – UBS’s Nuti

Technologists working to automate indications of interest from trading desks

Botched copy: Esma delivers cut and paste pastiche of Trace

Mifid transparency mishmash misses key aspects of US system it emulates, say dealers

CME asks clients about changing implied UST futures coupon

Falling yields prompt review of 6% conversion factor for delivery-eligible bonds

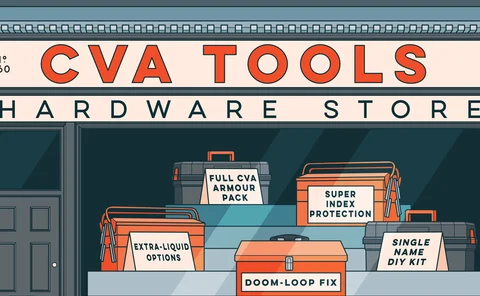

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies