High-quality liquid assets (HQLAs)

US regionals may get $8bn capital break in Fed proposal

Under tailored framework, mid- and small banks would also get $77bn liquidity relief

US ‘transfer restrictions’ take a bite out of UBS’s LCR

Overseas subsidiaries are holding more HQLA to meet local liquidity requirements

State Street HQLA shift dampens investment yields

Allocations to agency mortgage-backed securities increase to 38.4% of portfolio total

Bank of America posts lowest LCR to date

The firm's LCR fell to 120% from 122% in third quarter

European LCRs improve as cash outflows drop and HQLA rises

Greek banks' liquidity buffers lag far behind EU average

LCR gap between EU and US banks widens further in H1

State Street had the lowest LCR, at 108%, and UniCredit the head of the pack with an LCR of 179%

Liquidity risk of non-systemic US banks differs from G-Sibs

PNC, US Bancorp, Capital One cannot rely on cash inflows in a market panic

US banks cut surplus deposits caught by LCR

Eight US banks show aggregate $6.5 billion decline in non-operational deposit outflows under liquidity measure

US LCR cash inflows dominated by secured loans

Median US systemically important bank counts secured loans as 73% of total cash inflows

Cashflow turbulence up at Citi, JP Morgan

Maturity mismatch add-ons have grown since June 2017

Tri-party repo switch prompts Credit Suisse liquidity boost

Swiss bank LCR surges to 226%

US foreign bank rules sap UBS liquidity buffer

HQLA fell Sfr2 billion in the second quarter, down 17% since US IHC formed

Large non-systemic US banks call for tailored liquidity rules

Two banks urge lawmakers to provide LCR relief because they do not fall into G-Sib category

Japanese banks load up on HQLA

Aggregate liquid assets increase ¥22.3 trillion year-on-year

JP Morgan, Wells Fargo excess reserves dwindle faster than Fed average

Total banking sector excess reserves have dropped 5.8% since Fed "normalisation" began

Goldman: bank liquidity needs will stall QE unwind

Economists at US bank expect Fed balance sheet to drop less than $1 trillion from 2017 peak

Business growth and HQLA cuts see US LCRs fall

Cutbacks in high-quality liquid assets and higher deposits drive reductions across the G-Sibs

Morgan Stanley LCR dips

Increased lending commitments boost net cash outflows

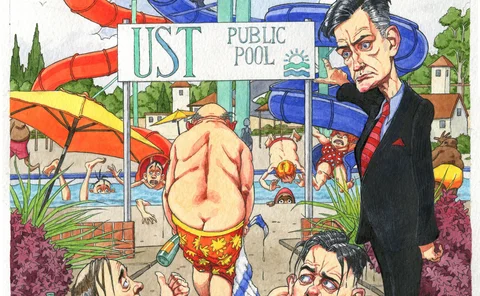

Crapo bill could end LCR limbo for three banks

US Bancorp, PNC and Capital One stand to benefit if House passes bill

Credit Suisse bolsters liquidity buffers

LCR reinforced in response to choppy markets

UBS liquidity coverage ratio shrinks after regulatory change

The rule change led to higher net cash outflows at the bank, which jumped 5.5% to Sfr135 billion in March

State Street bolsters liquidity buffers

HQLA share of investment portfolio grows from 61% to 70% in the first quarter

Basel liquidity rules block Fed’s QE exit

LCR and NSFR could produce $1 trillion shortfall in plans for balance-sheet ‘normalisation’