Futures commission merchant (FCM)

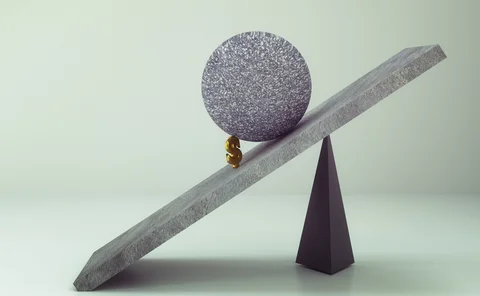

US clearing banks still push for leverage ratio IM offset

Potential cut in ratio and adoption of SA-CCR not enough to stop shake-out, FCMs warn

Fed backtracks on CCAR cleared swaps exposure

Regulator had also postponed plan to feed cleared client exposure into G-Sib rankings

Mifid II position limits regime faces non-EU reporting woes

Position reports will contain “meaningless information”, experts warn

Banks prepare for battle with Fed over G-Sib rules

Proposals would kill client clearing business, FCMs claim – but postponement is a chance to fight back

Fed postpones G-Sib capital change

Industry reprieve granted on proposal that threatens $10 billion capital increase

CFTC commissioner wants say over bank capital rules

Inability to influence SLR is “incredibly frustrating”, says Quintenz

Dealers blame US futures IM dip on low vol

CFTC data shows required initial margin down 15% since start of 2017

Fed G-Sib plan threatens 50bp jump in FCM capital

Banks rail against proposals that would scoop up $46trn in cleared trades

Banks win concessions in battle over CCP margin models

European Commission proposal would shine light on clearing house margin charges

Giancarlo: SLR change would cut clearing capital by 70%

Isda AGM: netting of clearing collateral would boost activity without weakening banks, claims CFTC chair

MEP: Basel too slow to deal with clearing capital clash

Isda AGM: Swinburne criticises Basel’s lethargy on clash between leverage and clearing rules

CFTC counsel warns of threat to clearing portability

Leverage ratio seen as biggest impediment to porting client positions

CCP chiefs warn on clearing provision capacity

Ice and LCH question whether direct buy-side clearing models can alleviate capital crunch

Regulators may consider portability in CCP fire drills

BoE, BaFin and CFTC move signals concern over whether client positions can be moved between banks in a crisis

Start-up looks to break swaps clearing bottleneck

Sernova promises everything an FCM can do – apart from taking risk

Clearing portability under threat as FCM pool shrinks

Failure of big clearing brokers could see clients unable to move to stable competitors

Banks seek to pry open CCP black boxes

Clarity on model inputs may have averted Brexit chaos, FCMs claim

Clearing house of the year: LCH

Risk Awards 2017: CCP enjoys stellar year for volumes, and demonstrates willingness to adapt following Brexit stresses

Why liquidity risk is the silent clearing killer

A quant paper shows feedback effects can amplify CCP margin requirements in stressed markets

EU net margin rules are riskier than US regime, warns CFTC

Commission’s Bandman raises margin financing as emerging systemic risk to CCPs

Barclays loses top clearing exec

Industry has seen string of departures from senior clearing roles over past year

Emir countdown raises cost questions for the buy side

Firms fear wider spreads, lower liquidity after May 21 frontloading date

Basel Committee to amend leverage ratio calculation

CEM to be ditched, but regulators still considering treatment of client margin

Banks unyielding in contract talks on clearing

European buy-siders that leave clearing-contract talks too late could be told 'take it or leave it', lawyers warn