Foreign exchange

Consultants fear mis-selling as forex brokers discover new options

Range accrual and Tarf variants too complex for UK SMEs, critics say

Cutting edge: Incorporating forex volatility into commodity spread option pricing

Spread option pricing: importance of forex risk factors illustrated

Best in Malaysia: CIMB Group

CIMB wins best in Malaysia award

An innovative multi-asset solution for electronic trading

Sponsored video: Societe Generale

Germany’s CFD providers look to boost market share

CFD activity on the increase but banks keep their distance

CLS wins 'patent troll' Supreme Court case

Market disruption averted as unanimous decision goes in CLS's favour

Asset quality trumps hedging cost in volatile currencies

Correlation of currency and underlying asset militates against hedging

Smile transformation for price prediction

Prediction of arbitrage-free option prices that outperform existing models

EC tries to close forex loophole in Emir

Consultation launched in attempt to harmonise reporting rules; FCA will "engage closely"

Nasdaq OMX to decide on forex clearing by mid-2014

Clearer is talking to banks about possible service

Costs of forex manipulation could be worse than Libor

Total bill from penalties and lawsuits could reach “tens of billions,” some estimate

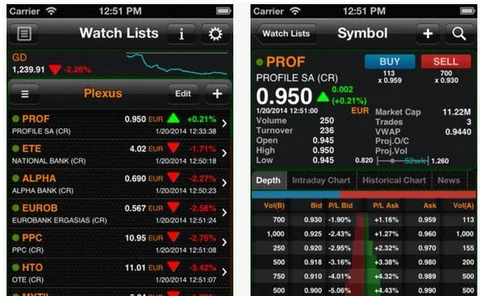

Profile software readies market data mobile app

Athens-based technology provider Profile Software has launched a new mobile app, dubbed Plexus, which allows users to monitor real-time data and news on their iPhone and iPad devices.

Insch: the more equity markets fall, the better

A systematic, trend-following currency program can serve as a hedge against falling equity markets

Esma calls for EC to overrule UK on forex reporting

"We need a solution," says Esma spokesman

CFTC tells Sefs to collect paper Isda master agreements

Platforms will need to obtain paper copies of users' contracts in order to confirm non-cleared trades

Local correlation families

Local correlation families

What’s next for FX structured products, ETFs and indexes?

Sponsored forum: Bloomberg Indexes

UK and EC clash over forex reporting exemption

The FCA and EC diverge over whether certain forex derivatives are subject to mandatory reporting

Risk awards 2014: HSBC wins top house

The UK bank wins for the growing ambition of its OTC capabilities, as Risk publishes its fifteenth annual awards

Currency derivatives house of the year: Bank of America Merrill Lynch

Currency derivatives house of the year: Bank of America Merrill Lynch

Sefs battle with confirmations after CFTC relief expiry

A second no-action relief period that exempted Sefs from issuing confirmations expired on November 29, leaving forex traders unsure whether Sefs can handle the requirement

Industry in discussions to change FX benchmark calculation, says ECB official

Senior market participants have suggested widening the time window in which benchmark exchange rates are set in foreign exchange, following allegations of manipulation

CCPs face $161 billion liquidity shortfall to clear FX options, GFXD finds

Results of an industry study reveal the scale of the liquidity burden that would fall on CCPs clearing physically delivered forex options – but a net settlement mechanism could reduce the number by 73%

FX industry calls for changes to benchmark practices

Ongoing investigations into manipulation of forex benchmarks have led to calls for changes to the way the WM/Reuters exchange rates are used