Foreign exchange

One vision, two paths: UK reporting revamp diverges from EU

FCA and Esma could learn from each other on how to cut industry compliance costs

Wild dollar swing upended FX options hedges

Banks chased vol higher as last week’s EUR/USD surge knocked out barrier trades

Will lifer exodus kill Taiwan’s NDF market?

Traders split over whether insurers’ retreat from FX hedging is help or hindrance

Rethinking FX sales – unlocking margin and client value through modern technology

Understand why legacy FX sales tools have become a commercial liability and how modern, human-centred platforms can improve productivity, reduce risk and enhance client outcomes

SpectrAxe steps into FX forwards and swaps

US regulatory filings show options Clob is expanding into linear instruments

How JPM AM swapped platforms for pipes

Asset manager wanted to cut FX venues – and their fees – out of dealer relationships. Now, it only trades direct

US mutual funds slash short euro positions at record pace

Counterparty Radar: Pimco cut $4.6bn of EUR/USD puts in Q3 amid changing stance on dollar direction

Nomura hires new global eFX head

Mark McMillan to oversee e-trading and sales activities in newly created role

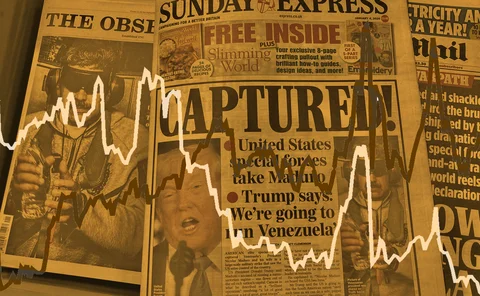

Trump’s LatAm gambit spurs FX hedging rush

Venezuela op boosts risk reversals as investors look to protect carry trades

FXGO volumes surge despite fee switch-on

Dealers split on whether levy is behind volume increases across SDPs

Kyriba sees uptake in AI-assisted FX hedging tools

Automated data collection and cleaning helps corporates create better hedges and has cut unexplained P&L moves by 87%, says vendor

US insurers turn to short-dated FX forwards as notionals rise

Counterparty Radar: Trades under three months make up nearly 60% of total positions, up from just a third in 2022

FX swaps price discovery challenges buy side, says Vanguard

Lack of transparent price validation data for FX forwards and swaps is holding back buy side, Vanguard’s head of FX says

Dealers warn of capital squeeze from increased FX hedging

Sharp rise in uncollateralised buy-side hedges could restrict banks’ ability to take on positions

Floating exercise boundaries for American options in time-inhomogeneous models

A pricing model is extended to account for negative interest rates or convenience yields

Quants tell FX dealers how to make the most of passive liquidity

Paper from HSBC and Imperial sets out when to skew pricing, and when not

Dealer views mixed over future of profitable EM FX carry trade

Emerging market FX carry trades have generated 7.5% returns since April, but dealers question longevity

Banks scale back short-dated FX swaps trading, BIS finds

Interbank FX swaps hit by higher short-term hedging and funding costs, while longer-dated forwards activity jumps

All that glisters: precious metal volumes surge on FX venues

Gold and silver liquidity on foreign exchange trading platforms improves as more dealers link precious metals with e-FX

MAS official flags risks in Asia’s path to T+1 settlement

Regulator says region faces “unique challenges” in establishing a shorter settlement cycle

CME futures outage caused FX spot pricing problems

At least one non-bank was forced to pull prices, and NDFs also affected