Fixed income

JP Morgan’s head of Emea rates joins Citi

Tom Prickett joins US bank as Emea head of G10 rates

JP Morgan announces structuring team changes

New unified team to report to structuring head Rui Fernandes, and includes new roles for senior staff

Market shocks push IRC to records at EU banks

Component for default and migration risk hits new highs at several dealers

Central bank watch: Biased to ease, for now

A mid-year review of the monetary policy outlook for G10 central banks, India, China and South Korea

A paradigm shift for prepayment risk assessment

For MBS investors, the ability to link data to specific loans and securities offers more precise analysis, alongside other advances in data and analytics

Fixed income finesse: striking a balance amid shifting rates

An increasingly unpredictable economic environment leads investors to look for a wider range of products to satisfy evolving strategies

The future of fixed income

Apac investors’ use of fixed income products, the fast-track evolution of the UBS fixed income proposition and the innovations likely to be seen by 2030

Vol ‘too low’ given US uncertainty, say market-makers

Isda AGM: Panellists warn against complacency heading into the summer as US 90-day tariff pause rolls off

Dodging a steamroller: how the basis trade survived the tariff tantrum

Higher margins, rising yields and stable repo funding helped avert another disruptive blow-up

Ice eyes year-end launch for Treasury clearing service

Third entrant expects Q2 comment period for new access models that address ‘done-away’ accounting hurdle

For US Treasury algos, dealers get with the program

Four banks now offer execution algos on Bloomberg, with plans to go further, faster

BlackRock tests ‘quantum cognition’ AI for high-yield bond picks

Study uses Qognitive machine learning model to find liquid substitutes for hard-to-trade securities

TD’s prop-style trading shop rises up bond rankings

Ascent of bank’s bond trading business comes amid electronification changes in US fixed income market structure

SG looks beyond equity derivatives in new markets push

French bank aims to expand fixed income business to achieve “more stable” revenues across asset mix

UBS sterling rates head departs

Ian Hale left the Swiss bank in December

Iosco mimics industry codes to tackle pre-hedging dilemma

Advocates breathe sigh of relief, but Iosco release carries suggested restrictions

Exchanges vie for EGB futures market

Rivals eye Eurex’s dominance in EGB futures, but dealers are split on the likelihood of challengers succeeding

Exchange of the year: Eurex

Risk Awards 2025: Eurex jolts credit futures market into life

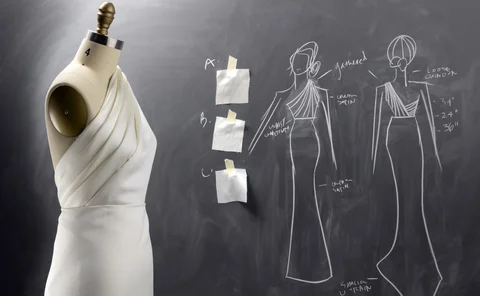

Structured products house of the year: UBS

Risk Awards 2025: bulked-up structuring team is more than just the sum of its parts

Credit derivatives house of the year: JP Morgan

Risk Awards 2025: Continued investment in credit has created a virtuous circle of growth, as cash products support derivatives, and vice versa

Derivatives house of the year: UBS

Risk Awards 2025: Mega-merger expected to add $1 billion to markets revenues, via 30 integration projects

BofA’s e-FX rebuild pulls it closer to rivals

Deploying its equities tech stack, bank seeks to get ahead of the pack with algo and e-FX offerings

Republican SEC may focus on fixed income – Peirce

Commissioner also wants a revival of finders’ exemption, more guidance for UST clearing

Yield curve chronicles: mastering fixed income in volatile markets

A series of four podcasts that examines fixed income investment strategies against a backdrop of economic uncertainty, potential rate cuts and market volatility