Financial markets

Asia moves: New CEO for BNP Paribas Cardif, GIC gets new COO, plus more

Latest job changes across industry

Ensemble models in forecasting financial markets

In this paper, the authors study an evolutionary framework for the optimization of various types of neural network structures and parameters.

IFRS 17 Special report 2019

The insurance industry has long been vocal about the need for a two-year extension to the International Accounting Standards Board’s (IASB’s) proposed 2021 implementation date for International Financial Reporting Standard (IFRS) 17 – the accounting…

Asia moves: BlackRock picks new Asia head, Credit Suisse boosts regional solutions, and more

Latest job changes across industry

Dependence dynamics among exchange rates, commodities and the Brazilian stock market using the R-vine SCAR model

The objective of this paper is to assess the dependence dynamics among Brazilian real exchange rates, commodity prices and the Brazilian stock market using a regular vine copula combined with the stochastic autoregressive copula model.

How to apply Python to complex financial markets

The unprecedented proliferation of data in derivatives markets has led to a rise in popularity of Python, a multipurpose programming language known for its versatility and flexibility. Undoubtedly, the increased adoption of Python has helped enable…

Balance-sheet interest rate risk: a weighted Lp approach

In this paper, the authors introduce a new interest rate risk measure that is a product of two factors: one related to the distance between assets and liabilities in the Lp-space of financial instruments, and the other linked to the performance of the…

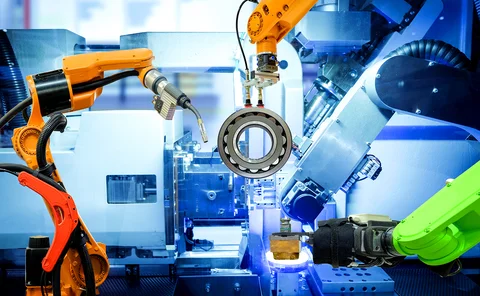

Asia embraces intelligent automation

Asia’s adoption of new tools and processes has gained significant momentum, with increased automation now a primary focus for many financial firms. Paul Worthy, head of Japan at Tradeweb, explores how this change has come about, and how firms can use the…

If regulations don’t bend, they’ll break

Financial regulation should be adaptive, not reactive, argues Andrew Lo

A CCP is a CCP is a CCP

This paper discusses the many differences between CCPs and banks as well as the significance of these differences.

Asia Risk Interdealer Rankings 2018: The winners

Societe Generale and BGC top the tables

The predictability implied by consumption-based asset-pricing models: a review of the theory and empirical evidence

This paper examines whether two well-known models, Campbell and Cochrane’s habit model and Bansal and Yaron’s long-run risks model, can produce significant return predictability.

When do central counterparties enhance market stability?

This paper examines the impact of market structure and payment assumptions on the fragility of various networks.

Central counterparty resolution: an unresolved problem

This paper describes the current policy for recovery and resolution of CCPs and assesses the tool kit for resolution of them.

European split on NSFR worries dealers

Squabble over derivatives liabilities factor sparks fears of unlevel playing field

Ranking the economic importance of countries and industries

The authors present a methodological framework for quantifying interdependencies in the global market and for evaluating risk levels in the worldwide financial network.

Rethinking risk management in the age of cognitive computing

Content provided by IBM

Networks and lending conditions: empirical evidence from the Swiss franc money markets

In this paper, the author provides an empirical analysis of the network characteristics of two interrelated interbank money markets and their effect on overall market conditions.

Statistical testing of DeMark technical indicators on commodity futures

This paper examines the performance of three DeMark indicators over twenty-one commodity futures markets and ten years of daily data.

Quantifying the diversity of news around stock market moves

In this paper, the authors use a topic-modeling approach to quantify the changing attentions of a major news outlet, the Financial Times, to issues of interest.

Granularity, a blessing in disguise: transaction cycles within real-time gross settlement systems

The authors of this paper take us into the world of granular time series data.

A multilayer model of order book dynamics

This paper presents a two-layer order book model.