Equity futures

One Trading brings 24/7 equity trading to Europe

Start-up exchange will launch perpetual futures Clob in Q1 after AFM nod

Asia investors turn to inverse ETFs for hedging

US-based Direxion eyes Asia listings, while CSOP expands product range to single names

Tariff whiplash fuels clearing volumes at major CCPs

Record OCC volumes and strong gains at CME and Eurex mark April’s tariff-driven trading spike

Novel risk-off CTA strategy passes tariff test

Ai for Alpha’s defensive approach to trend following worked as planned in April turmoil

Snowballs show signs of life amid China stock rebound

A-share jump and expiries drive new issuance, but dealers say regulations are depressing volumes

Cboe plans Q2 dispersion futures listing

Expectations of post-US-election uncertainty drives launch, and could help bank equity desks hedge OTC risks

CME to launch single-stock futures

Exchange will focus on ‘Mag 7’ tech names after rivals fail with broader offerings

EU index managers face funding risks as US moves to T+1

Rotations from European to US assets will need prefunding due to slower EU settlement

Robinhood buys Marex FCM as futures entry takes shape

Retail broking giant follows WeBull into futures market

China snowball knock-ins fuel futures sell-off

Market participants say issuer re-hedging has helped drive Chinese equity indexes lower

China equity for global investors: reopen, recover, re-enter

At a panel session convened at Risk.net’s ETF & Indexing Forum in Hong Kong, experts from FTSE Russell, Citi, BlackRock and CSOP Asset Management discussed the latest investment trends and challenges, and the opportunities afforded by China A-shares…

China eyes new derivatives contracts to boost investor morale

Regulator announces futures and options products on mainland and HK, but there are doubts it will help

Eurex wargames pricing derivatives during disruption events

Ukraine war and tech glitches prompt German exchange to set out methods for handling market closures

Concern over sluggish adoption of ESG futures

While the number of products is on the rise, very few have underlying liquidity

Nasdaq takes aim at equity TRSs with bespoke futures

Can custom basket forwards convince buy-side firms to ditch bilateral swaps?

China stock slump hits snowball issuers

Sharp selloff in CSI 500 index threatens pain for local issuers of popular structured products

Sales of China’s snowball notes fall

Issuers point to tighter equity index basis and recent regulator warning over marketing of snowballs

Many ESG products face liquidity struggle, say exchanges

Fragmentation, design and definition challenges mean many exchange-traded products will remain illiquid

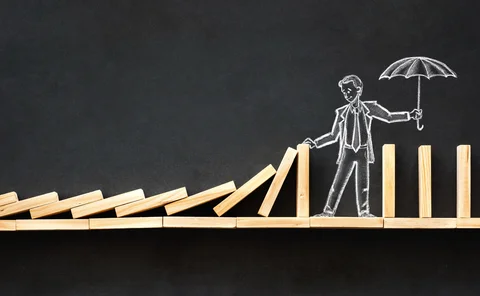

Solving the domino effect of delayed trade allocations

One year on from the pandemic-driven volatility of March 2020, Joanna Davies of Traiana looks at how buy-side firms can gain greater visibility and efficiency in exchange-traded derivatives (ETD) markets

Vix vulnerable to retail short squeeze, analysts warn

Volatility products could see more wild swings as dearth of vol sellers exacerbates spikes

Dividend delays upend pricing of Eurostoxx futures, options

Investors that rolled futures contracts before companies axed AGMs “could have lost a lot of money”